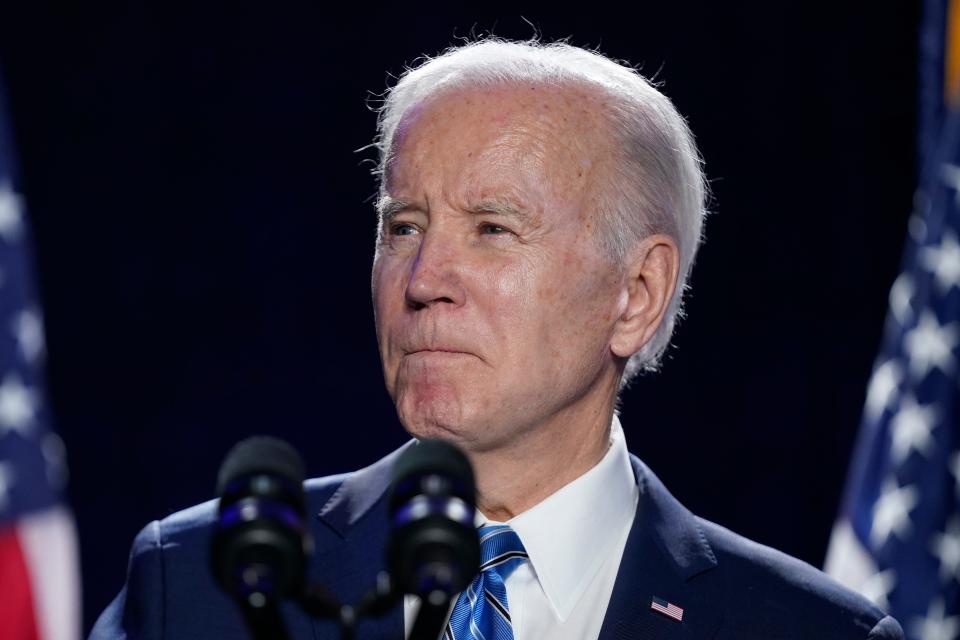

President Joe Biden's budget proposal will include tax increases. What are they?

WASHINGTON – Wealthy Americans will pay higher taxes under the proposed budget that President Joe Biden will send to Congress on Thursday, but Biden says he will keep his promise not to raise taxes on middle-class Americans.

“I want to make it clear: I’m going to raise some taxes,” Biden said during a trip to Virginia Beach, Virginia, last week.

However, people making less than $400,000 a year “will not pay an additional single penny in any tax,” he said.

The budget blueprint will be the first that Biden has submitted to the Republican-controlled House, which is unlikely to go along with his proposal to raise some taxes. Congress is in charge of writing the federal budget, and Biden’s spending plan will become the starting point for negotiations between lawmakers and the White House.

This year’s budget talks will come amid a brewing battle between congressional Republicans and the White House over raising the limit on how much money the federal budget can borrow. House Republicans say they won’t raise the debt ceiling unless Biden agrees to sharply cut spending.

If Congress doesn’t raise the borrowing limit, the U.S. Treasury will run out of money to pay government bills such as Social Security and military paychecks this summer, according to the nonpartisan Congressional Budget Office.

What is Biden’s billionaires' tax?

Biden hasn’t offered specifics on his latest plan to raise taxes on the wealthy. But during his State of the Union address in February, he called on Congress to “reward work, not just wealth” and pass his proposal for a billionaires' minimum tax.

His so-called “billionaires' tax” is likely to mirror a proposal that he offered last year. That plan called for a 20% minimum income tax on multimillionaires and billionaires, which Biden said would lead to a fairer tax code and would prevent the nation’s highest earners from paying a smaller share than middle-class Americans.

The tax would apply to American households with more than $100 million – about 0.01%, representing the 700 richest Americans. It could create an additional $361 billion in tax revenue over the next decade.

The push for a billionaires' minimum tax comes amid a debate over the uneven distribution of wealth and whether the rich pay their fair share. In a typical year, billionaires pay an average tax rate of just 8%, according to the White House. A minimum tax would make sure that the wealthiest Americans no longer pay a tax rate lower than teachers and firefighters, Biden said.

Boosting Medicare tax to extend solvency

Biden is asking wealthy Americans to pay a higher Medicare tax rate to increase the life expectancy of the program, which is projected to become insolvent in 2028.

Biden will propose raising the Medicare tax rate on earned and unearned income above $400,000 from 3.8% to 5%, a move that he says will extend the program's solvency through 2050.

"My budget will make sure the money goes directly into the Medicare trust fund, protecting taxpayers’ investment and the future of the program," Biden wrote in an op-ed published Tuesday in the New York Times.

He also wants to close loopholes that some high-paid professionals and other wealthy business owners use to shield some of their income from the tax by claiming it is neither earned nor investment income.

Higher taxes on corporate stock buybacks

Biden also called during his State of the Union address for Congress to quadruple the new tax on corporate stock buybacks.

A bill that Biden signed into law last year requires companies to pay a 1% excise tax on purchases of their own stock, effectively forcing them to pay a penalty for a maneuver they have long used to return cash to their CEOs and investors and bolster their stock price.

Corporate stock buybacks have exploded in recent years as companies have raked in cash from record-high profits. Some of the world's biggest oil giants, for example, are reporting billions of dollars in annual profits for 2022 – a year when consumers around the globe faced soaring energy prices. At one point last year, the average gas price in the U.S. topped $5 a gallon.

Biden argues energy companies should invest more of that profit into increasing domestic production and keeping prices down. Quadrupling the tax on stock buybacks would encourage long-term investments, Biden said.

Will Biden try to raise the corporate tax rate?

As a presidential candidate, Biden promised to raise taxes not only on the wealthy but also on large corporations. A tax plan pushed by then-President Donald Trump and congressional Republicans in 2017 lowered the corporate tax rate to 21% from 35%, although many companies pay much less.

Biden proposed raising the corporate tax rate to 28% last year. But that plan died in the Senate amid objections from Sens. Joe Manchin, D-W.Va., and Arizona’s Kyrsten Sinema, who was a Democrat at the time but has now become an independent.

The White House would not say whether Biden plans to resurrect that idea in his new budget proposal. But raising the corporate tax rate would be one way to raise money for new programs and help Biden keep his promise to lower the federal deficit by $2 trillion over 10 years.

The chances of such a proposal getting through Congress, however, are even more remote now that Republicans are in charge of the House.

Michael Collins covers the White House. Follow him on Twitter @mcollinsNEWS.

Dig deeper

How do rich people avoid taxes? Wealthy Americans skirt $160 billion a year in tax payment

Debt ceiling negotiations leave GOP few options: Where can they cut (and where can't they)?

Tax code under fire: President Biden says the tax system 'is not fair' in SOTU

'Sound the alarm': National debt hits $30 trillion as economists warn of impact for Americans

This article originally appeared on USA TODAY: Biden budget to call for billionaires' tax, Medicare tax hike