Trump tax cuts added less than $2 trillion to debt, nowhere near 25% | Fact check

The claim: Trump’s tax cuts for the wealthy are responsible for a quarter of the national debt

A May 17 Facebook post (direct link, archive link) includes a screenshot of a tweet that blames the last president for current economic conditions.

“Donald Trump’s tax cuts for the obscenely wealthy are responsible for a QUARTER OF OUR NATION’S ENTIRE DEBT and Republicans want to cut YOUR social security to pay for it, and that’s what this debt ceiling bulls--- is all about,” reads part of the post.

It was shared more than 800 times in less than two weeks. Other versions of the claim were shared thousands of additional times.

Follow us on Facebook! Like our page to get updates throughout the day on our latest debunks

Our rating: False

Estimates vary on exactly how much Trump's 2017 tax bill added to the national debt, but none place its impact at 25% of the total figure. Experts told USA TODAY more than a quarter of the national debt was added during the Trump administration, but most of it was due to COVID-19 relief funding and not tax legislation.

Trump tax policy added less than $2 trillion to debt

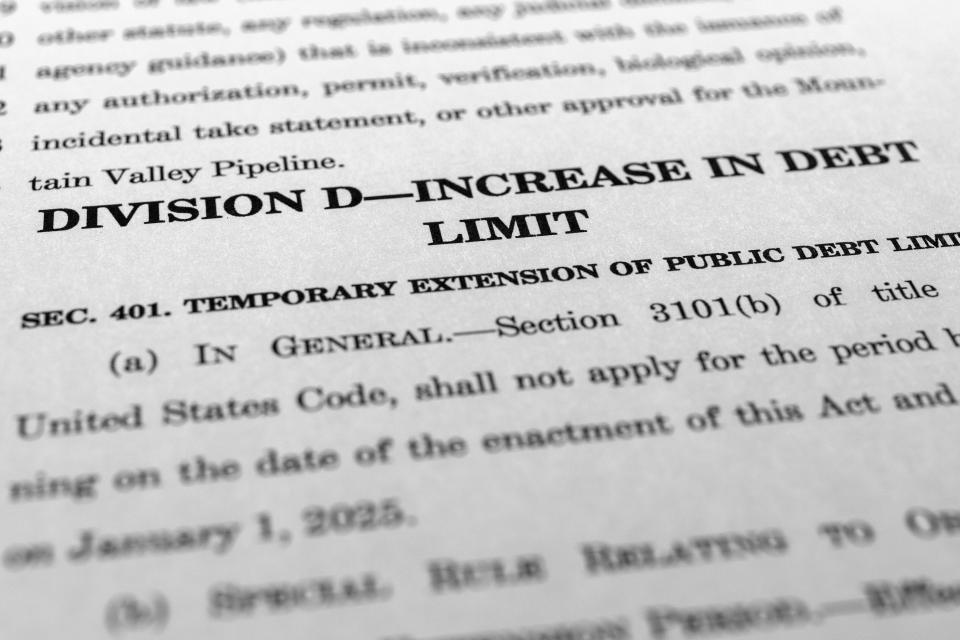

National debt has been a key point of contention as Congress as of May 30 hadn't yet passed a deal to raise the debt ceiling and avoid a default that could come with economic catastrophe, as reported by USA TODAY.

Estimates on exactly how much the 2017 Tax Cuts and Jobs Act affected the national debt vary, but none show a tally close to 25% of the national debt, which currently sits at $31.5 trillion.

Among other changes, the act dropped the top corporate income tax rate from 35% to 21% and reduced income taxes for most Americans.

As of May 2020, the Tax Policy Center estimated the tax cuts would add between $1 and $2 trillion to the federal debt by 2025. The Center for American Progress estimated the bill will have cost roughly $1.7 trillion by the end of fiscal year 2023 on June 30.

Will McBride, vice president of federal tax policy for the Tax Foundation, said an estimated cost of $1.5 trillion and adjusted net cost of $1 trillion mean it's "not even in the ballpark" of making up one-fourth of the national debt.

It even pales in comparison to the $6 trillion spent in light of the COVID-19 pandemic, which was used on aid such as stimulus checks and unemployment benefits.

Based on federal debt data, Both McBride and Ben Page, a senior fellow at the Tax Policy Center, said more than a quarter of the nation's debt was accrued while Trump was president. But that the spending is largely because of the pandemic and not the tax bill.

PolitiFact previously debunked a similar claim by New York Rep. Alexandria Ocasio-Cortez, who asserted that Trump’s tax cuts were the largest contributor to the national debt.

USA TODAY reached out to users who shared the post for comment. One user directed USA TODAY to reporting that showed roughly 25% of the nation's debt was incurred during the Trump administration, but not that the 2017 tax bill alone is responsible for it.

Our fact-check sources:

Treasury Department, accessed May 30, What is the national debt?

Ben Page, May 26, Email exchange with USA TODAY

Will McBride, May 26, Phone call with USA TODAY

Center for American Progress, March 27, Tax Cuts Are Primarily Responsible for the Increasing Debt Ratio

Tax Policy Center, May 2020, How did the TCJA affect the federal budget outlook?

Thank you for supporting our journalism. You can subscribe to our print edition, ad-free app or e-newspaper here.

Our fact-check work is supported in part by a grant from Facebook.

This article originally appeared on USA TODAY: Claim overstates Trump tax cuts' impact on national debt | Fact check