Republicans move tax bill, putting objections on hold

WASHINGTON — Two Republican critics of the Senate’s tax reform legislation voted to advance the bill out of committee and send it to the Senate floor Tuesday afternoon without adding their desired changes to it.

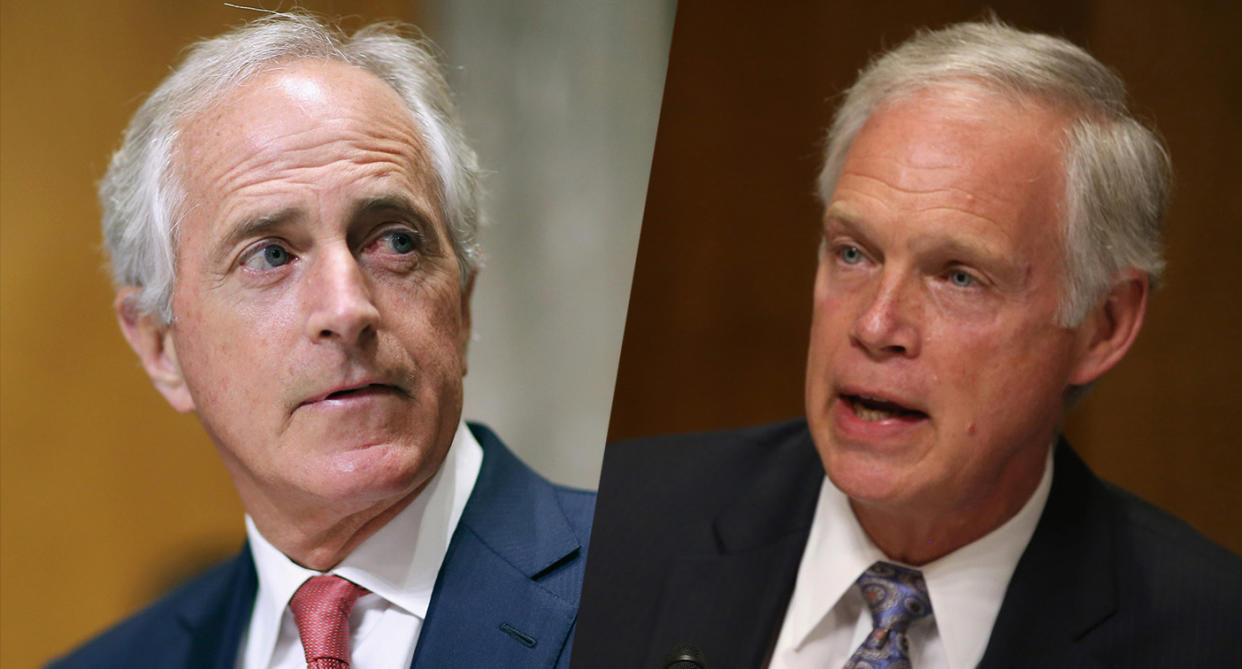

Sen. Ron Johnson, R-Wis., and Sen. Bob Corker, R-Tenn., both voted to advance the measure out of the Budget Committee in a party line vote after Senate Republicans met with President Trump for an hour over lunch. Johnson had threatened to block the bill if it was not amended to include a lower pass-through tax rate for small-business owners.

Johnson and Trump went back and forth over the issue at the lunch, and Johnson told reporters he was convinced enough progress was being made for him to vote the bill out of committee — a key first step that could deliver the president his first legislative victory.

Corker, meanwhile, is working with Republican Sens. James Lankford of Oklahoma and Jeff Flake of Arizona to include a provision to the bill that would trigger tax increases if the legislation does not generate enough economic growth to offset the steep cuts.

Johnson and Sen. Steve Daines, R-Mont., both want more generous pass-through rates for small businesses, which would likely increase the deficit even more than the $1.5 trillion already projected. Republican leaders would have to find other ways to pay for those lower rates, which would likely lead to more objections from senators over new issues. Senate Majority Leader Mitch McConnell, R-Ky., compared whipping votes on the bill to a “Rubik’s cube.”

But in the hourlong lunch, the president stressed that these problems could be solved later in the process.

Sen. Pat Roberts, R-Kan., said four or five senators expressed their problems with the bill during the meeting with the president, and the president urged them to address those issues either through amendments on the Senate floor or in a conference committee after the bill passes and is reconciled with the House version.

“The position expressed by the president was we can address these issues in conference or wherever,” Roberts said.

But some senators want assurances of changes before the bill reaches the floor, which could happen as early as Thursday.

Susan Collins, R-Maine, says she is still undecided as she works with Senate leadership on her desired changes.

“I’m an undecided on the tax bill, but I am encouraged by the meetings I’ve had today and the receptivity to the changes that I’ve proposed be in the bill,” Collins said after the meeting.

Collins said she wants the bill’s child tax credit to be refundable, meaning those in the lowest income brackets can receive it as a cash refund, for the top income tax rate to stay at the current 39.6 percent for couples making over a million dollars and to retain deductions for state and local taxes. The Senate bill lowers the top rate to 38.5 percent and eliminates state and local tax deductions, hitting taxpayers in higher-tax states and cities.

Collins also says she wants the Senate to pass a bill that would stabilize Obamacare’s individual markets before she votes for the tax reform bill. The tax reform bill eliminates Obamacare’s individual mandate, which could cause premiums to spike in the individual markets.

“That’s one of my top issues because it will cause premiums to go down,” Collins said of the Obamacare fix.

Sen. Jim Risch, R-Idaho, said the tone of the Republican caucus is more positive compared with when their bid to repeal and replace Obamacare failed over the summer, and that no senator has drawn a line in the sand.

“The mood is very different. People really want to get to yes on this,” Risch said.

Read more from Yahoo News: