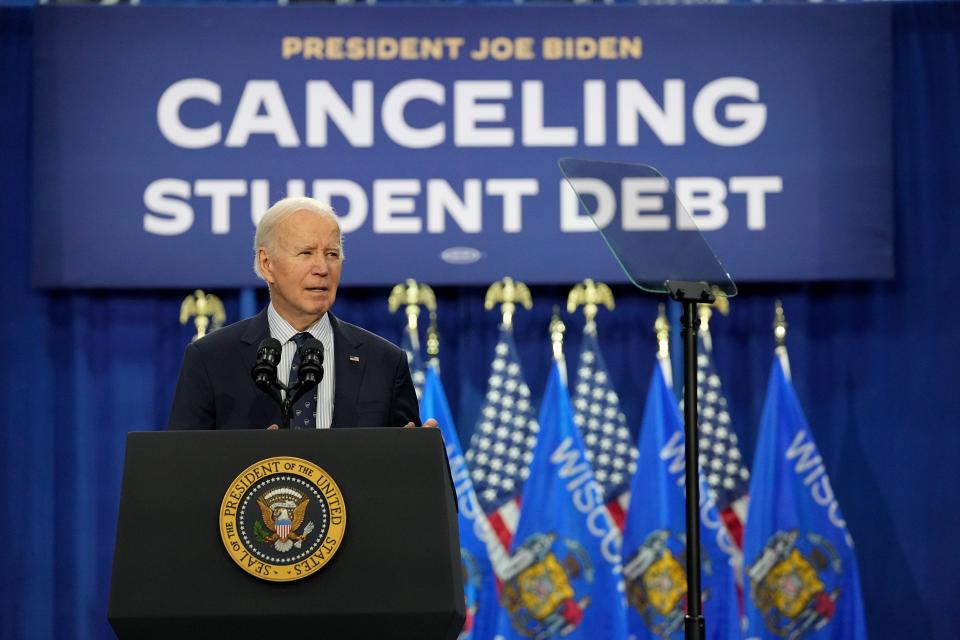

President Joe Biden unveils student debt forgiveness plan in trip to Madison. Here is what to know

MADISON — President Joe Biden unveiled a new student loan debt forgiveness plan for millions of Americans during a Monday visit to Madison Area Technical College.

More than 4 million student loan borrowers could see their debt fully canceled under the proposal, according to the White House. In addition, more than 10 million borrowers could get $5,000 or more in relief. Biden also hopes to eliminate interest past the original loan amounts of 23 million borrowers.

"While a college degree still is a ticket to the middle class, that ticket is becoming much too expensive," Biden told a crowd gathered in the college's gym. "Too many people feel the strain and stress, wondering if they're going to get married, have their first child, start a family. Because even if they get by, they still have this crushing, crushing debt. And it's not just a drag on them, it's drag on our economy."

The announcement comes nearly a year after the U.S. Supreme Court knocked down Biden's first attempt to cancel borrowers' debt. Conservatives on the court said the $400 billion program needed congressional approval. It would have canceled up to $10,000 in federal student loan debt for borrowers earning less than $125,000 per year.

Biden immediately vowed to come up with a new program, the broad strokes of which he outlined Monday. It was the president's third visit to Wisconsin this year. Biden and high-level members of his administration have frequented this battleground state as he seeks to fend off a challenge from Republican former President Donald Trump in November.

As of now, Biden and Trump are each tied at 49% among registered voters in Wisconsin, where races are often decided on razor-thin margins.

Here's what to know about Biden's visit:

More than 700,000 Wisconsinites have student debt

Wisconsin's 700,600 borrowers hold $21.4 billion in federal student loan debt, according to the latest federal education data.

An analysis by the University of Wisconsin's Student Success Through Applied Research Lab found in 2020 that the largest group of borrowers — 23% of those with student debt — owed between $20,000 and $40,000, and 21% owed between $10,000 and $20,000.

"President Biden and I both know that the dream of pursuing a higher education looks a bit different these days than it did when we went to college. Today, high costs can often be a barrier for kids and families and families pursuing their dream," said Democratic Gov. Tony Evers ahead of the president's speech. "Higher education should be affordable and accessible for every Wisconsinite who chooses it, period."

Different types of borrowers targeted for relief

The plan would help:

Borrowers who owe more than they did at the start of repayment. They would have up to $20,000 of that interest wiped away, leaving them to repay only the amount they originally borrowed. People making less than $120,000 a year would qualify for having all of their interest forgiven if enrolled in an income-driven repayment plan.

Borrowers who are eligible for other loan forgiveness programs, but have not yet applied. New rules would authorize the U.S. Education Department to cancel the debt for those people without their having to apply. Among these programs are Biden's Saving on a Valuable Education (SAVE) Plan and the Public Service Loan Forgiveness.

Borrowers who have made payments for decades. People who took out federal student loans for undergraduate degrees and began repaying them more than 20 years ago would automatically have the debt canceled under the new plan. The same would apply for graduate students who began paying 25 years ago.

Borrowers who attended colleges that have lost their certification or eligibility to participate in the federal student aid program.

Borrowers experiencing "hardship" paying back their loans. People with other expenses, such as high medical debt or child care, that make it difficult to pay off their loans now or in the future could apply to have their student loans forgiven.

Biden has launched other loan relief efforts

The president's Saving on a Valuable Education plan has saved nearly 2,000 Wisconsin borrowers $13.8 million, officials announced in late February.

The plan — commonly known as SAVE — promises a lower monthly bill and a shorter path to loan forgiveness. The plan bases monthly payments on income and family size and is readjusted every year.

Borrowers with undergraduate student debt pay 5% of their discretionary income, down from 10% or 15% in other plans. For those with graduate debt, the cap is set at 10%. Borrowers with a mix of undergraduate and graduate debt have payments weighted somewhere between the two.

Madison business owner Ashley Storck touted the SAVE plan before Biden's remarks. Under the plan, Storck said, she and her partner saw their monthly payments go from $700 to $0.

Program's timeline unclear

Most of the program will require an extensive public comment period before it can take effect, likely July of next year at the earliest, experts say.

But the Department of Education is considering taking actions to expedite parts of the plan, which could bring relief to some borrowers as soon as this fall.

Court challenges could be coming

The plan is based on the Higher Education Act, a different law than the one struck down last summer and one Biden officials said would hold up stronger to legal challenges.

But like the previous effort, this one may face challenges from conservative groups.

“These loan schemes do not forgive debt," Louisiana Sen. Bill Cassidy, the ranking Republican on the Senate Health, Education, Labor and Pensions Committee, said in a statement. "They transfer the debt from those who willingly took it on to the 87% of Americans who decided to not go to college or already worked to pay off their loans. This is an unfair ploy to buy votes before an election and does absolutely nothing to address the high cost of education that puts young people right back into debt.”

Republican U.S. Rep. Bryan Steil, R-Wis., called student loan cancellation unconstitutional, unfair and inflationary.

"The president is simply shifting the burden to those individuals that paid off their student loans or worked their way through school or chose to take a career that didn’t require a four-year education," Steil told reporters. "The president should explain to someone who is working as a carpenter in Kenosha how this plan is fair to them."

He accused Biden of “trying to buy votes” by targeting students in Madison with his message and said he thinks the Supreme Court would deem this latest student loan debt cancellation effort unconstitutional.

Governor's task force studied student debt

Evers in 2020 created a task force to study student loan debt in Wisconsin. At the conclusion of its work, the task force recommended creating a borrower bill of rights and student loan ombudsman for the state, reinstating the state's Educational Approval Board and tightening oversight of proprietary schools, expanding financial literacy education, increasing funding for need-based, targeted aid, improving access to loan counseling, expanding loan forgiveness programs, offering loan refinancing and creating a student debt income tax credit.

"By working to get Wisconsinites out from under student loan debt, President Biden is helping give folks a little more breathing room in their household budgets to save, buy a home, to buy a car, start a family, start a business and prepare for the future. And he’s helping make sure our kids have the future and opportunities that we promised them," Evers said Monday.

Republicans slam Biden plan

"Let’s be honest about what’s going on here: Joe Biden is in trouble," Republican Party of Wisconsin chairman Brian Schimming told reporters, referencing polling numbers showing Biden trailing Trump in most swing states. "There’s an eclipse going on here today, and that is Joe Biden’s polling numbers being eclipsed by Republicans."

He claimed Biden visited Madison, Democrats’ main stronghold in the state, to shore up support among a critical group of Democratic voters he will need to win in November.

“What we have here today is the ‘Joe Biden bribe,’” Schimming said. “He’s coming in to try to buy voters that he’s been losing out of his base with this whole scheme that he’s got coming in here today.”

Steil said the underlying issue with student debt is the high cost of college, saying Biden’s plan does nothing to address it. He suggested tying schooling to workforce needs in the state would help graduates find jobs. He said school administrators need to assume the responsibility “to control the cost of the educational product in the first place.”

USA Today contributed.

Jessie Opoien can be reached at [email protected]. Kelly Meyerhofer can be reached at [email protected].

This article originally appeared on Milwaukee Journal Sentinel: Biden unveils student debt forgiveness plan. Here is what to know