What we know about the 6,000 pages of Trump tax returns, Republican response and more: recap

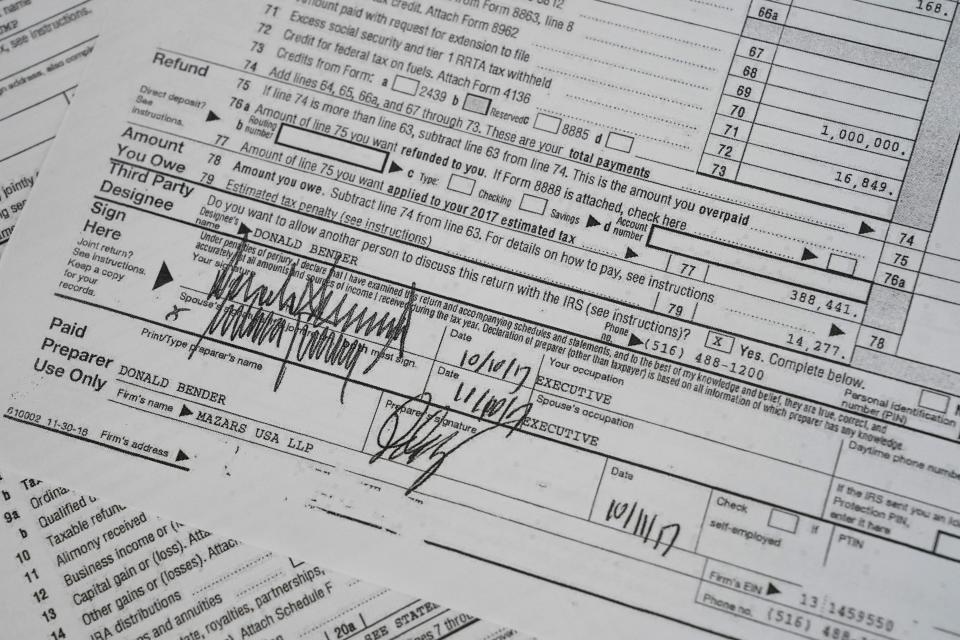

The top tax-writing committee in Congress released former President Donald Trump’s tax returns to the general public Friday morning, ending a yearslong battle and shedding light on a complicated labyrinth of businesses and holdings typical of billionaires but rarely seen in detail by the public.

The release included six years of tax returns for the time he was president and campaigned for the presidency, from 2015 to 2020. Thousands of pages across dozens of files included personal returns filed by him and his wife, Melania, and business returns for a handful of entities, including DJT Holdings and DJT Managing Member LLC.

The returns span nearly 6,000 pages, including more than 2,700 pages of individual returns from Trump and his wife and more than 3,000 pages in returns for Trump’s business entities.

A key congressional committee that reviewed the returns before their release raised questions about hundreds of millions of dollars in deductions and credits that reduced how much Trump and his related companies would have needed to pay in taxes. They also questioned interest income from loans made to his children and unusual accounting calculations.

The Joint Committee on Taxation, staffed with tax experts, found Trump paid only $1.1 million in federal income taxes during the first three years of his presidency and paid no federal tax in 2020 – the year that he claimed a loss of $4.8 million.

Where can I see the trump taxes pdf?: Read the documents here

Stay in the conversation on politics: Sign up for the OnPolitics newsletter

Today, the Committee released the final piece of supporting evidence in our investigation into the IRS's mandatory audit program under the prior administration.

Find Attachment E here ?? https://t.co/i8iuviZaYe— Ways & Means Committee (@WaysMeansCmte) December 30, 2022

Trump blasted Democrats for releasing his returns, arguing the premise that it would guide tax law changes is baseless. He said in a video statement that the release is an “outrageous abuse of power” and urged House Republicans taking over the chamber in January to obtain President Joe Biden’s tax returns and release them.

Trump said his returns show “show only that I've had tremendous success.”

“I spent my entire life building a truly great company. Over the years I've employed 1000s and 1000s of people, I build towering skyscrapers standing tall above the greatest cities of the planet,” he said. “Most politicians only know how to kill jobs, I have actually created them, but by the thousands.”

One prominent tax lawyer, Martin Press of the Florida-based Gunster law firm, urged caution in reviewing Trump's newly released returns, saying they need to be viewed in the proper context that includes his business records and other details.

"An income tax return is merely that," Press told USA TODAY. "It determines what is income and how it is taxed. It is not designed as a balance sheet showing historical or current values of assets. Trump’s tax returns must be read in conjunction with his prior FEC (Federal Election Commission) filings that would indicate values of assets as submitted by Donald Trump."

Download and read a copy of Trump's tax returns

You can access Trump’s tax returns from 2015-2020, including individual and business returns. Trump’s business tax returns include holding companies for investments and trademarks, like Trump Plaza, Trump Taj Mahal Casino Resort and Mar-a-Lago. The House committee that oversees taxes also analyzed the findings of Trump’s tax returns in a 40-page summary report.

View the congressional staff report and complete tax returns here.

Are tax returns public record?

A person's tax returns are supposed to be shielded by privacy laws, but the committee obtained Trump's returns by arguing they were needed to guide possible changes in tax laws.

Republicans countered that the release would set a dangerous precedent undermining privacy protections.

The release Friday included redactions of some personal sensitive information, such as Social Security and bank account numbers.

Every president and major-party candidate since Richard Nixon has voluntarily made at least summaries of their tax information available to the public. Trump bucked that trend as a candidate and as president.

'Regrettable stain' on Ways and Means Committee

Rep. Kevin Brady, R-Texas, the top Republican on the House Ways and Means Committee, accused Democratic committee leaders of unleashing a “dangerous new political weapon.”

“This is a regrettable stain on the Ways and Means Committee and Congress, and will make American politics even more divisive and disheartening,” he said in a statement Friday. “In the long run, Democrats will come to regret it.”

Trump tax returns: House committee report shows IRS failed to conduct 'mandatory' audits

Released: Supreme Court denies Donald Trump request to block release of tax returns to House panel

What is Trump's net worth?

Trump has always claimed to be a billionaire, but some financial analysts have questioned that assertion, citing his frequent bankruptcies, business failures and questionable valuations of real estate holdings.

An estimate from Forbes, which tracks billionaires’ wealth, pegged his net worth this week at $3.2 billion.

The former president’s fortune is derived from New York City real estate holdings, golf courses, a winery and licensing deals for usage of his name around the world, the publication said. He also got a $730 million bump from the Trump Media and Technology Group, which owns Truth Social.

Earlier: Will Trump's taxes become public? Here's what to expect if a House panel votes to release them.

Trump tax records in historical context

Two presidential historians told USA TODAY that the release of Trump’s taxes is an important step for democracy because it gives the public insight into the former president’s taxes.

"Trump's tax documents release shows exactly why we Americans must know everything about the finances of any future aspiring president of the United States,” said historian Michael Beschloss. "If we don't learn everything about his or her finances, a future president may turn out to have violated ethics or law, or be gravely indebted to shadowy people and institutions capable of damaging our American democracy."

Matt Dallek, another presidential historian, said the release of Trump’s tax returns “reflects a sense on the part of Democrats that Trump was not just a partisan foe but also a clear and present danger to democracy, on a par with someone like Nixon.”

“The release of Trump's tax returns also symbolize how his opponents justifiably believe that Trump as president acted as if he was beyond the law, that normal rules didn't apply to him and that he could do whatever he wanted,” Dallek said.

Dallek said the release also signaled how informal norms, such as the expectation that presidential candidates and presidents would release their returns, are unreliable. “The system, in other words, relied too much on the assumption that presidents would abide by modern mores and norms, which was clearly a misjudgment when it came to Trump,” Dallek said.

Republicans release ‘dissenting views,’ warn of retribution against Democrats

Republican members on the committee that released Trump’s taxes issued a blistering “dissenting views” report Friday afternoon that accused Democrats of not giving them enough time to review the records or prepare for the meeting Dec. 20 in which they voted on the release.

Though courts sided with Democrats seeking the release to guide future lawmaking, Republicans argued the release is “not supported by a legitimate legislative purpose.”

“This effort began with a single goal: Obtaining and publishing the former President’s tax returns,” the report signed by Rep. Kevin Brady, R-Texas, says. “Everything else has been nothing but a search for a pretextual justification for accomplishing that goal.”

The Republicans’ report warned the Democrats’ actions triggered “a new cycle of political retribution in Congress.”

“Democrats will come to regret this,” they said. “And they may regret it sooner than they think.”

Trump made money abroad, paid taxes in multiple countries

Trump, whose companies own properties all over the world, reported making $45.8 million in 2018 before expenses in two dozen countries including the United Kingdom, Ireland, Indonesia, India, and an unnamed country not listed in the IRS database of country codes.

He paid about $344,000 in foreign taxes that year. He paid $1,340 in India, $429 in Uruguay, and $342,315 in an unnamed country. Trump also claimed carryover that resulted in a foreign tax credit just under $1.3 million. The Joint Committee on Taxation recommended the IRS request receipts to verify the tax payments.

Here are some of the major issues the Joint Committee on Taxation previously raised about Trump's taxes:

Business expenses zeroing out taxes

Many businesses for which Trump and his wife filed taxes from 2015 through 2020 made no money. Often, they reported only expenses, or they reported income that was almost entirely offset by the reported expenses, effectively zeroing out any taxes owed.

The filings raise questions about “whether these were valid trade or business activities” or “costs derived from personal activities or hobbies,” the committee experts wrote. The returns show:

Trump’s speaking business reported income of $50,000 in 2015 and travel expenses of $46,162.

In 2016, DT Endeavor I LLC – Trump’s private aviation company – reported income of $680,886 and expenses of $680,886. The same for DJT Aerospace LLC, another aviation company, which reported gross income of $376,493 and total expenses of $376,493 in 2016.

In 2019, a business filing for Melania Trump's modeling work reported gross income of $3,848 and expenses of $3,438.

In 2020, another filing reported as “Management Services” under Donald J. Trump reported gross income of $87,442 and expenses of $87,442.

Some filings also reported losses with large discrepancies between gross income and expenses. For example, in 2018, DJT Endeavor I reported gross income of $38,392 and expenses of $312,773, meaning the company operated at a net loss of $274,381. In 2019, another aviation company, DJT Operations II LLC reported no gross income at all while there were expenses of $7,382.

In graphics: A complete visual timeline of the 4-year legal battle over Donald Trump's tax returns

Trump companies use unusual accounting method for real estate

Two of Trump’s real estate companies accounted for costs in a way more commonly used by manufacturers and merchandisers to track inventories.

DJT Holdings LLC used the method, which congressional tax experts said generally shouldn't be used in real estate, to claim between $22.7 million and $29.1 million in costs each year from 2015 to 2019. In all those years, the business posted major losses. Affiliated company DJT Holdings Managing Member LLC did not use the method, known as cost for good sold, in 2015 and 2016 but started using it in 2017. The tax experts questioned the change in business practices.

Loans to Ivanka Trump, Eric Trump and Donald Trump Jr.

Donald and Melania Trump reported roughly $300,000 in interest income from 2015 through 2020 from loans to his children. From 2015 through 2019, the income was $51,000 a year. In 2020, it fell to $46,000.

The congressional tax experts said the transactions raise a “question of whether the loans were bona fide arm’s length transactions” or whether they were “disguised gifts” that could have triggered a gift tax and made them unable to deduct the interest expenses.

A $21 million charitable contribution?

The 2015 return for Trump and his wife includes a $21.1 million charitable contribution for the donation of a conservation easement to the North American Land Trust. The 159-acre strip of land near his Seven Springs estate in Westchester County, New York, may have been overvalued in an appraisal, IRS auditors had noted in their review of Trump’s returns.

Their notes also raised the possibility of reducing the allowed deduction amount by more than $10 million and assessing a penalty. The full deduction was not taken in 2015 but was part of a carry-forward amount eligible for deducting in future years. The matter is still under review. IRS agents had been set to meet with appraisers in November.

Prosecutor: Evidence shows Trump 'explicitly' sanctioned alleged tax fraud scheme at two companies

Trump companies on trial: Prosecutors' opening says case is about 'greed and cheating'

Carrying over millions in losses

The 2015 return shows $105 million in losses carried over from previous years. In 2016, the carryover was $73.4 million, and in 2017 and 2018, it was $45 million and $23 million. The tax experts noted the losses should be verified. Such operating losses incurred before 2018 can "generally be carried forward 20 years,” the experts noted.

Hotel expenses

A tax filing in 2015 for one of Trump’s business entities, DJT Holdings LLC, includes a deduction for $13.9 million in hotel expenses – part of more than $24 million in deductions overall. In 2016, it reported the same amount of $13.9 million in hotel expenses of $22.2 million total in deductions. The 2020 return included $7.2 million in hotel expenses – part of $10.1 million overall.

The congressional tax experts noted it’s worth examining “the nature and reasonableness of these costs” and whether they included personal expenses, rather than business costs.

Tax fraud trial: Former Trump Organization CFO Allen Weisselberg holds back tears as he testifies

Gulity: Trump companies convicted on all charges in Manhattan criminal tax fraud case

Expense discrepancies between financial statements and tax returns

There was a large difference between management expenses for one of Trump’s businesses in 2020 and public financial reports.

The business reported roughly $400,000 in management expenses in the financial reports. But in Trump’s tax returns, it reported more than $950,000 in management expenses – a difference of about $550,000.

'DJT Holdings Managing Member'

The filings for DJT Holdings Managing Member LLC appear to be mostly flow-throughs – losses or transactions from other entities – and yet the LLC reported nearly $7,000 in deductions and negative earnings of $1.5 million in 2015.

“We would recommend requesting an explanation of these items,” the congressional reviewers noted, since the entity “does not appear to be engaged in an active operating trade or business during 2015.”

A $26.3 million rehab credit

The Trumps’ tax return in 2016 included a historic rehabilitation credit of $26.3 million. Such credits can be taken when a qualified building is rehabbed and placed in service, but rules for such tax breaks are stringent, leading congressional experts to recommend further examination.

Real estate companies discharged as much as $141 million in debt

The committee questioned how two real estate companies used a Great Recession-era law to help the businesses ease the tax burden on up to $141 million of forgiven debt.

The report pointed to a total of $28.2 million that DJT Holdings LLC and DJT Holdings Managing Member LLC claimed each year as income on their 2016, 2017, and 2018 forms 1040.

Go deeper:

What Trump taxes show: House committee report concludes IRS failed to conduct 'mandatory' audits

Dems vote to release: House panel votes to release Trump tax information despite threats from Republicans

Final appeal: Supreme Court denies Trump request to block release of tax returns to House panel

Contributing: Josh Meyer, David Jackson and Kevin McCoy; The Associated Press

This article originally appeared on USA TODAY: Trump's tax returns released by House Democrats: recap