GOP senators already want changes to House tax reform bill

WASHINGTON — A handful of Republican senators are already asking for significant changes to the House’s sweeping $1.51 trillion tax reform bill released Thursday that lowers income and corporate tax rates while eliminating some popular deductions.

But overall, Republicans in Congress’s smaller and slower chamber are taking a more deferential tone to the framework than they did on the House’s Obamacare repeal effort six months ago, perhaps signaling that the legislation has a better shot at passing in some form.

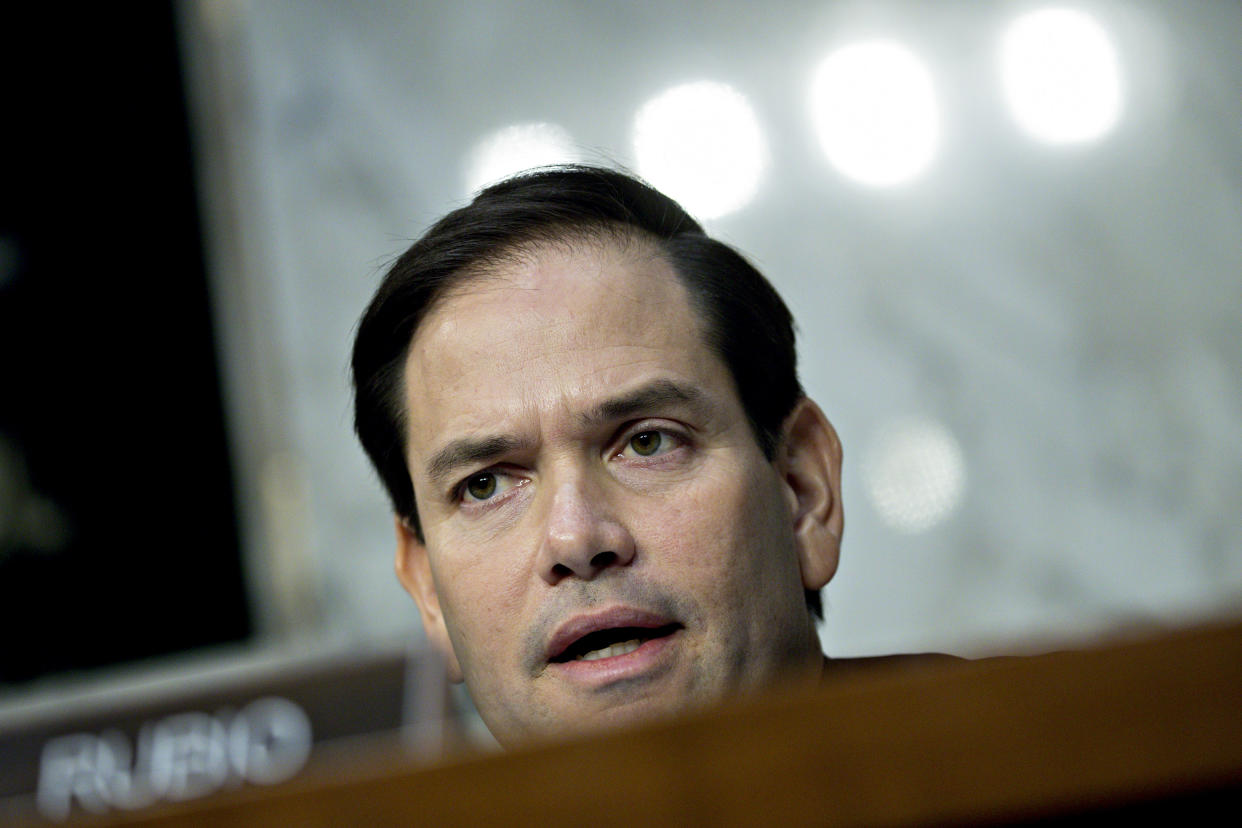

Sen. Marco Rubio, R-Fla., said he wanted the bill to include a $2,000 refundable child tax credit, a policy that has been endorsed by White House adviser Ivanka Trump. The House bill’s child tax credit currently stands at $1,600 and is not refundable.

“That’s where it needs to be, that’s where it has to be,” Rubio said of the higher amount.

Sen. Ron Johnson, R-Wis., said he was unhappy with how the bill treats pass-through business rates, where some business owners can categorize 70 percent of their revenue as personal wages and the other 30 percent as business income that is taxed at 25 percent. The change is meant to prevent wealthy people from avoiding income tax by only paying the new, lowered 25 percent corporate rate.

“The issue with the pass-throughs has got to be fixed, it’s not acceptable,” Johnson said.

Sen. Bob Corker, R-Tenn., said his staff was still examining the House bill but that he wants $4 trillion in loophole closures as part of the plan to ensure the tax cuts don’t add to the deficit. He also stressed he wanted the tax rate changes to be permanent.

Sen. Susan Collins, R-Maine, said she was pleased to see the top rate of nearly 40 percent unchanged for income over $1 million, but declined to comment on whether she supported the overall bill until she had time to examine it further. The bill caps mortgage interest deduction at $500,000, which would disproportionately effect homeowners in states like Maine where many people own second houses.

The Committee for a Responsible Federal Budget estimates that the corporate tax cuts will cost $2.2 trillion, while various business deduction and exemption eliminations will raise just $1.2 trillion. Overall, House leaders expect the tax plan will cost $1.51 trillion.

Multiple Republican senators called the House bill a “starting point” or “first step” — reminding reporters they will craft their own bill. By and large, the party’s response to the bill was far more positive than in the hours after the House released its Obamacare repeal plan, when many senators were more dismissive of the initial framework. This reflects a general understanding in the Republican caucus that they must deliver on tax reform to avoid losing seats — and donors — in the 2018 midterms.

“We’re going to take them seriously because we want to get it done on the Republican side, and the best way to do that is to make sure we are not becoming adversarial,” said Sen. James Inhofe, R-Okla. “That has happened before, you know.”

In an interview with a Wisconsin radio host Monday, Speaker Paul Ryan said House leaders had “pre-negotiated” the framework with the White House and Senate, after learning lessons from the Obamacare failure. The House passed a repeal bill while the Senate never managed to.

“I do believe that every American senator understands this, they get this,” Ryan said of the importance of passing tax reform.

But a lot of convincing and negotiation remain ahead. Republican senators were still learning the outlines of the plan Thursday and many were unable to comment on specific provisions.

“He didn’t pre-negotiate it with me!” Sen. John Kennedy, R-La., said of Ryan when asked if he knew the outlines of the House tax bill earlier this week.

Each individual GOP senator wields significant power, given that Republicans can only lose two votes and pass a bill if Democrats continue to oppose this tax reform effort. And the effort to sell the plan could get complicated as constituents learn about the elimination of popular deductions needed to pay for the lower income and corporate tax rates.

“I’ve been telling all my constituents, look, you gotta understand this is not all gravy, it’s not all cheesecake,” Kennedy told Yahoo News. “To get to the cheesecake, you gotta go through the spinach. It’s like a big ol’ piece of cheesecake with a big ol’ hunk of spinach on top and you gotta eat the spinach first.”

Read more from Yahoo News: