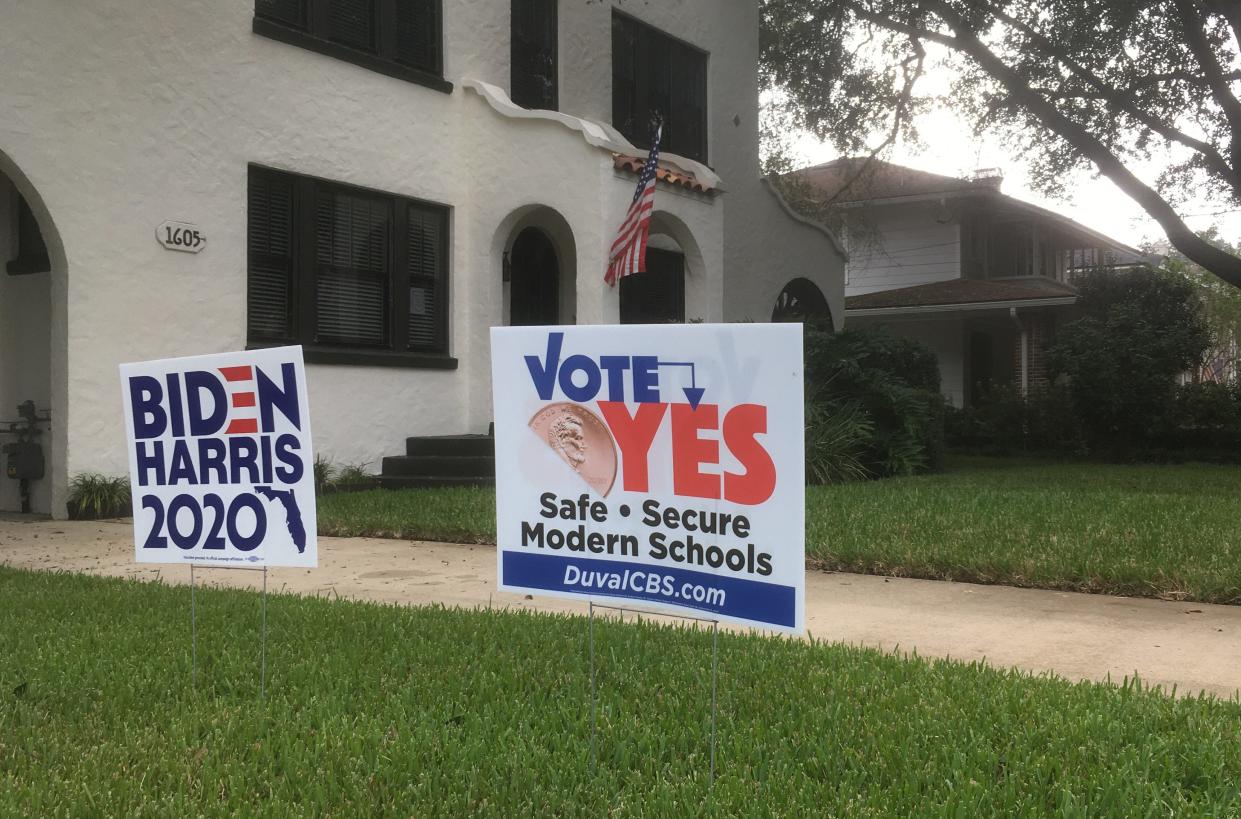

Duval Schools ahead of pace with sales tax revenue, concerns continue about charter spending

Despite concern that the COVID-19 pandemic and labor shortages could impact sales tax revenue, the Duval County School District is actually ahead of schedule with collections with $110 million coming in last year, according to the first annual report from the Sales-Surtax Oversight Committee.

The committee — tasked with monitoring how sales tax dollars are spent — also doubled down on concerns about how charter schools are spending their required share of the collections and wants to see more transparency in the future.

The committee — which is composed of 22 members, including two non-voting members, Superintendent Diana Greene and a student government representative — met for the first time in January 2021.

Construction underway

The committee's report highlights the school district needs that sparked the sales tax campaign in the first place, including the age of school buildings — some of the oldest in the entire state — and state funding cuts that have contributed to a $243 million backlog in maintenance.

The sales tax revenue will go toward realizing Greene's master facility plan, which includes building 27 new schools, improving security and technology districtwide, major repairs and renovations and removing school portables across the district.

To date, dozens of projects are underway and some — like security upgrades — have already been completed.

More: It's been a year since Duval Schools' sales tax launched. How are things going?

But dipping enrollment in traditional schools — prompted by the COVID-19 pandemic and other environmental factors — coupled with increasing charter school enrollment could force changes in the current master facility plan.

According to an audit that was reviewed at a School Board workshop in January, at least 20 schools' plans could be impacted. Conversations are still in the preliminary stages and would hinge on student enrollment surveys conducted later this year and next year.

More: Duval Schools dipping student enrollment could prompt changes to sales tax master plan

Still, the report's findings weren't shared with the oversight committee until a Times-Union reporter asked members about the potential changes. The audit and potential changes are not mentioned in the annual report either.

Sales tax generates $110 million in 2021

Duval Schools published a comprehensive project status dashboard last year that allows anyone to follow along with the status of new builds and construction as well as an estimated amount of money the sales tax has collected to date. Because the sales tax revenue is distributed on a quarterly basis, the dollar figures aren't always live.

The oversight committee's annual report reveals that in total, the sales tax generated $110 million for the entire year of 2021.

"We are proud that the sales tax has generated $110 million, which is ahead of schedule," oversight committee chairman Hank Rogers said.

On average, the sales tax generated about $7.9 million each month, which falls in line with the district's initial projections of between $6.6 and $8 million per month over the course of the 15-year tax.

Charter school oversight remains an issue

Of the $110 million collected, about $14 million went to the district's charter schools, which by state law are entitled to sales tax revenue on a per-student basis.

There were 30 charters eligible to receive a portion of the sales tax money last year. That number is expected to grow as more charter schools appear in Jacksonville.

As previously noted by the Times-Union, charter schools have more discretion than traditional public schools when it comes to how the tax money can be spent. The sales tax's campaign was based on capital expenses, like deferred maintenance, security upgrades and construction.

Nate Monroe: Millions of school sales tax dollars in Duval County are pouring into charter schools

But, members of the oversight committee have expressed concerns over the flexibility charter schools have to use the revenue for operational expenses like monthly rent payments and insurance as well as the lack of checks and balances in place when it comes to holding the charter schools accountable for how the money is spent.

"While we appreciate the district’s reporting, the Oversight Committee continues to be concerned with the lack of transparency of some of our charter schools’ reporting," the report said.

According to the new annual report, charter schools are allowed to use the sales tax revenue on five categories that traditional schools are barred from putting the funds toward:

Purchase of relocatables

Purchase of student transportation vehicles

Purchase of insurance

Motor vehicles

Media collections

In the report, the committee has recommended that the School Board and Greene work with an outside agency to develop a dashboard that tracks and explains how charter schools spend their share of the sales tax revenue, similar to the district's existing dashboard.

Other recommendations from the oversight committee

Besides wanting more accountability when it comes to how charter schools spend sales tax money, the oversight committee included several recommendations in its report regarding transparency on how the public is informed about money being spent.

Recommendations include using social media, newsletters and even encouraging City Council members to tell the community about the master plan projects underway and revenue coming in, "instead of relying on the half-penny website."

The committee also wants the district to get "Your half-penny at work" signs and to display them in front of schools that have active projects funded by the tax.

Other recommendations include the district promoting participation and opportunities with underrepresented groups and small businesses. The committee is also requesting that Greene or the School Board pursue an outside opinion regarding how sales tax funds can be spent.

Emily Bloch is an education reporter for The Florida Times-Union. Follow her on Twitter or email her. Sign up for her newsletter.

This article originally appeared on Florida Times-Union: Duval Schools ahead of pace with sales tax revenue, concerns continue over charter spending