With days left in session, Maryland Senate and House leaders agree to budget deal.

With days left in the Maryland General Assembly session, legislative leaders of both chambers agreed to budget items that will increase taxes on cigarettes for education funding and increase fees on electric vehicles for transportation funding.

A cigarette tax of $1.25 per pack was approved by a conference committee of the House of Delegates Appropriations Committee and the Senate Budget and Taxation Committee on Thursday afternoon. The funding is projected to increase funding for the state’s education law by $86.2 million in fiscal year 2025.

A surcharge for electric vehicles was also approved at a rate of $125 for a registration of a zero-emission vehicle and $100 for a plug-in electric vehicle. Those fees are projected to add $5.4 million each year to the state’s transportation funding for the next five fiscal years.

“It’s a great compromise,” said state Del. Ben Barnes, D-Anne Arundel/Prince George’s, who chairs the House Appropriations Committee, during the conference committee held in Annapolis where members of the House and Senate agreed to the revenue increases. “We share values,” noting both funding for a “robust transportation system” and a “world-class education system.”

“At the end of the day, budgets are what we care about,” said state Sen. Guy Guzzone, D-Howard, who chairs the Senate’s Budget and Taxation Committee, after Barnes spoke.

More: Bridge collapse: Limited channel opens near port. Senate committee passes emergency bill.

General Assembly session scheduled to end on Monday

News of a tentative agreement reached Wednesday (and confirmed on Thursday) by the House Appropriations Committee and Senate Budget and Tax Committee drew responses from legislative leaders of both chambers and both parties.

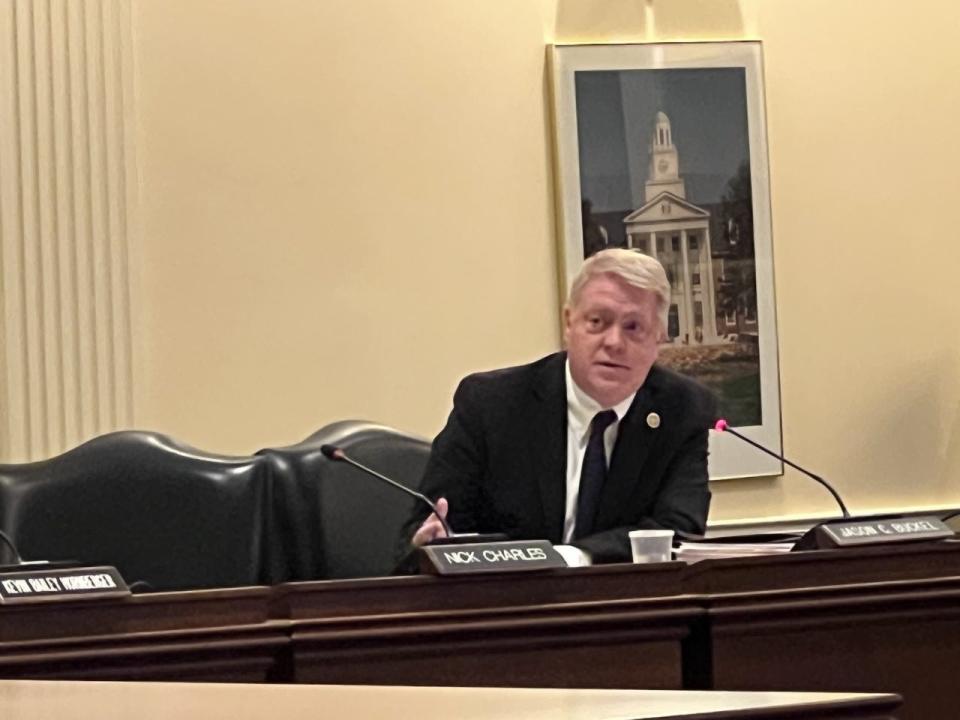

“While we are pleased that the more broad-based and draconian tax increases have been avoided - no increases in the vehicle excise taxes, no elimination of the vehicle trade-in credit - it is important to keep in mind that new revenues do not come from the government,” said House Minority Leader Jason Buckel, R-Allegany, in an April 3 release, upon the announcement chambers' agreement, “Any tax or fee increase comes from the pocket of hardworking Marylanders.”

The majority party leadership also hailed the agreement in an April 3 release.

“We remain committed to developing a comprehensive approach to transportation in the future this interim,” said House Speaker Adrienne Jones, D-Baltimore County, and Senate President Bill Ferguson, D-Baltimore City, in a joint statement on April 3, confirming a deal. “The agreement also keeps Maryland competitive and primed for economic growth in the year ahead.”

Budget includes for workers, businesses impacted by bridge collapse

The conference committee approved a transfer of up to $275 million from the state’s Rainy Day Fund to support the Maryland Protecting Opportunities and Regional Trade (PORT) Act, a state legislative effort backed by Ferguson and state Sen. Johnny Ray Salling, R-Baltimore County, to support workers and businesses affected by the Francis Scott Key Bridge collapse last month.

The agreed upon approximately $63 billion annual budget must be approved by both chambers before reaching the governor’s desk for final approval. This year’s session of the Maryland General Assembly session is scheduled to conclude on Monday, April 8.

More: Moore's Maryland budget boosts child care, education. What to know.

Dwight A. Weingarten is an investigative reporter, covering the Maryland State House and state issues. He can be reached at [email protected] or on Twitter at @DwightWeingart2.

This article originally appeared on Salisbury Daily Times: Maryland Senate, House leaders agree to budget deal to boost revenue