5 flood, homeowners' insurance musts and must-nots for Floridians during hurricane season

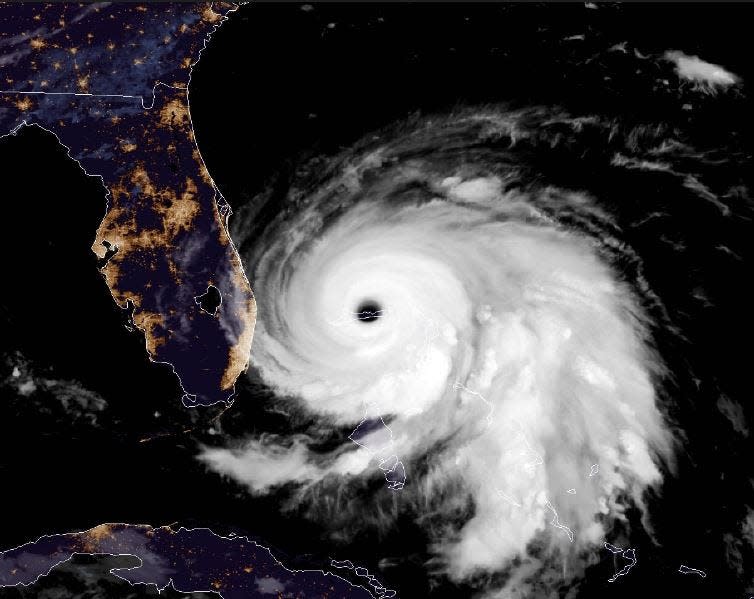

The height of Florida’s hurricane season is here and the National Hurricane Center is tracking tropical storm Franklin, which is anticipated to become a strong Category 2 storm.

Although Tropical Storm Franklin may not pose a direct threat to Florida, it’s not a bad idea to get your hurricane prep out of the way now. NOAA has predicted an active, above average Atlantic hurricane season.

And you don’t want to miss out on an insurance payout because you didn’t document the condition of your home before the storm or fully understand your home or flood insurance policy.

Here’s a “what not to do” list of common mistakes Floridians make when prepping their homes for hurricane season and how to avoid them, according to The Florida Association of Public Insurance Adjusters (FAPIA).

What should I pay attention to on my home insurance policy?

It might be tempting to file it away for later, but as soon as you get your home insurance policy, you should read through it and pay attention to a few key things. Don’t shove it in a drawer or folder or mark it to read later.

If disaster hits, you don’t want to be left in the dark about any exclusions your policy might have. For example, if you’re a new homeowner, you might not know that flood and home insurance are typically sold separately. Most home insurance policies don’t cover damages sustained from flooding.

You should pay close attention to the “Exclusions” and “Duties After Loss” sections to find out what your policy doesn’t cover.

What kind of home insurance do I need? Here are Florida's 8 types of homeowners' insurance

How do I know if my home is in a flood zone?

Don’t ignore your home’s vulnerabilities. Before a storm hits, you should familiarize yourself with how susceptible your property is to storm surge, flooding and wind damage and know which, if any, of these your policy covers.

You can use FEMA’s flood map to search for your address and find out how likely it is that your property floods during a major storm.

Living in Florida? These flood insurance facts could save you thousands

Don’t wait until your stuff is gone to find out how valuable it was

When an insurance company assesses any post-storm damage at your home, they will probably ask if you have any proof or documentation of its condition before the storm. Whether or not you have that to give your insurer will determine how much compensation you get back for damages.

Before a storm hits, use your phone camera to document the pre-storm conditions of your home, belongings and property. If you want to be really thorough, create a detailed list of your valuable belongings and include receipts for more expensive items like appliances, furniture and electronics.

Don’t delay buying flood insurance

Flood insurance, which is not usually included in home insurance policies, typically takes around a month or more to become effective. If your home floods during the waiting period, you won’t be covered by your flood insurance policy.

The best time to buy flood insurance is before hurricane season hits. If you aren’t covered for flooding this hurricane season, you can find a policy that works for you on the National Flood Insurance Program’s FloodSmart website.

Dropped from your insurance policy? Here's what to do

What should you do with important papers when planning for a disaster?

Don’t rely on paper copies of your most important documents.

Most Floridians know to keep their insurance policies, family medical information, deeds, wills and other important paperwork in a fire-proof, water-proof box or safe deposit box. But accessing those physical copies can be challenging if you’re in an emergent situation.

Scanning and uploading these documents to a cloud storage service like Google Drive, iCloud or Dropbox allows you to scan and access your important documents as long as you have cell service or access to Wi-Fi.

Lianna Norman covers trending news in Palm Beach County for The Palm Beach Post. You can reach her at [email protected]. You can follow her reporting on social media @LiannaNorman on X.

This article originally appeared on Palm Beach Post: Florida homeowners' insurance must-do things for 2023 hurricane season