Top 10 Stories of 2023: All Change at Kering

Over the past 60 years France’s Pinault family has transformed its businesses multiple times.

Fran?ois Pinault, who was 26 back in 1962, began his career trading wood in his hometown of Rennes. He would go on to build his fortune cycling through several industries — department stores, catalogs, electronics and furniture retailing among them — before settling on fashion.

More from WWD

His son Fran?ois-Henri Pinault, now chairman and chief executive officer of what became Kering, has done his share of transformations also, fine-tuning what was previously known as Gucci Group by trimming out sport/lifestyle holdings like Puma and Volcom and focusing on its clutch of European luxury goods brands, headlined by Gucci along with Saint Laurent, Balenciaga, Bottega Veneta, Alexander McQueen, Brioni, Boucheron, Pomellato, DoDo, Qeelin, Ginori 1735, Kering Eyewear and Kering Beauté.

In 2023, Kering marked its 10th anniversary with a family-style celebration dinner, a Flammarion book — and a string of deals and staff maneuvers that left many observers trying to catch their breath.

These included taking beauty in-house; acquiring Creed; investing in Valentino and forging a strategic alliance with Qatari investment group Mayhoola; recruiting new designers for Gucci and McQueen; parting ways with longtime Gucci executive Marco Bizzarri, and entrusting Saint Laurent president and CEO Francesca Bellettini with overseeing all the brands in the French group’s portfolio.

One of the most dynamic and driven managers in the luxury space, Bellettini was named a Kering deputy CEO, in charge of brand development. All brand CEOs now report to Bellettini, who is prized for her leadership, merchandising and communications skills.

Top 10 Stories of 2023 |

|---|

Entertainment and Fashion Converge |

The promotion was seen as recognition for her stellar work at Saint Laurent, which opened its biggest shop in the world on the Avenue des Champs-élysées earlier this month, and a key step as Kering seeks to further elevate its brands.

While she intends to function as a behind-the-scenes force — and not sit front row at any of the fashion shows for brands under her purview, excepting Saint Laurent, where she remains CEO — one can feel her hand behind certain recent initiatives, including Gucci’s launch of Ancora Notte eveningwear and menswear at the LACMA Art + Film Gala last month.

Bellettini is said to work closely with Jean-Fran?ois Palus, who relinquished his longtime role as group managing director at Kering to become president and CEO of Gucci ad interim. He relinquished his position on the board of directors of Kering and relocated to Milan until a successor for Bizzarri is named.

Bizzarri officially exited after the spring 2024 Gucci show that represented the debut of creative director Sabato De Sarno, a former Valentino designer who succeeded Alessandro Michele. De Sarno’s was the most anticipated show during Milan Fashion Week, attended by the likes of Julia Roberts, Ryan Gosling and Jessica Chastain — which was a clear indication of the power of another of the Pinault family’s acquisitions during the year, that of Hollywood uber agency CAA.

Jean-Marc Duplaix, Kering’s chief financial officer since 2012, was also named a Kering deputy CEO in charge of operations and finance. Completing the leadership transformation, former Chanel global CEO Maureen Chiquet joined the Kering board.

Analysts largely gave a thumbs-up to the management shuffle.

Royal Bank of Canada’s Piral Dadhania wrote in a note that, “We believe Kering’s revised organizational structure and change in leadership roles are a welcome step to further align group talent to better serve the needs of its maisons in our view. We believe this reorganization should be well received by the market.”

Kering also did its part this year in reigniting the luxury M&A scene.

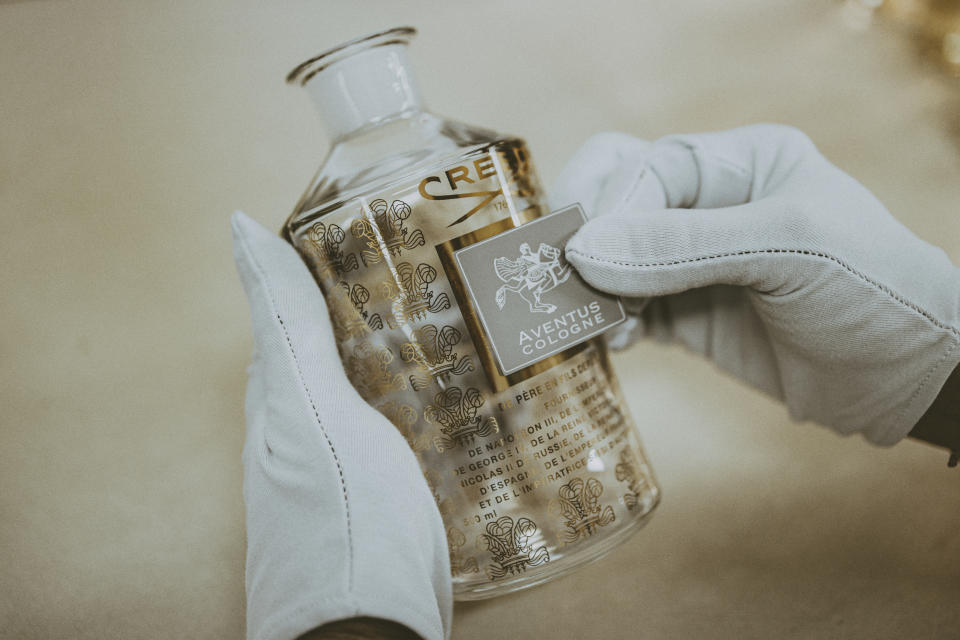

In June, it snapped up Creed, the high-end niche fragrance house previously controlled by BlackRock Long Term Private Capital Europe and chairman Javier Ferrán. The group’s ambitions were first revealed when it made a run at the Tom Ford business, which eventually was acquired by The Estée Lauder Cos. Inc.

It was the first big move since Kering began taking its beauty activities back in-house earlier this year, appointing Raffaella Cornaggia chief executive officer of Kering Beauté — a new position in a new division. She is charged with developing a team with expertise in the beauty category for Bottega Veneta, Balenciaga, Alexander McQueen, Pomellato and Qeelin.

“We have strong growth opportunities for Creed,” Pinault said at the time of the acquisition, noting the brand has very limited exposure to the Asia-Pacific region, little to no presence in travel retail, and room to expand its women’s lines.

Meanwhile, observers spy potential for strengthening the fragrance businesses of brands already in-house at Kering — and stretching them into other categories, such as color cosmetics and skin care.

In July, Kering surprised again by revealing it bought a 30 percent stake in Valentino for 1.7 billion euros in cash as part of a broader strategic partnership with Qatari investment fund Mayhoola.

Kering has an option to buy 100 percent of Valentino’s capital by 2028, while Mayhoola could become a shareholder in Kering. The new luxury partners are expected to jointly explore further opportunities aligned with their respective strategies, including potential investments beyond fashion.

At the time of the transaction, Pinault said the Roman fashion house fills a gap in Kering’s portfolio as the group targets wealthier customers with high-end products such as exotic leather goods and high jewelry.

“The potential of this brand is, in our opinion, quite significant for the next years to come,” Pinault said then.

“We definitely found in Kering and its leadership a like-minded institution,” Mayhoola CEO Rachid Mohamed Rachid told WWD in an interview earlier this year.

The group also made select acquisitions related to its supply chain. Boucheron revealed its first acquisition, a Paris-based workshop that has the Belter, Etablissements E. Blondeau, Chanson & Cie. and FG Développement companies under its umbrella, with an eye to reinforcing its high jewelry capabilities.

Finally, Kering Eyewear acquired Usinage & Nouvelles Technologies, or UNT, a France-based company manufacturing high-precision mechanical and metal components for the eyewear sector.

By now Kering has gained a reputation for changing creative leadership when brand momentum stalls, as it had previously done at Bottega Veneta and Gucci.

Yet it surprised in September when it revealed that Alexander McQueen designer Sarah Burton, who succeeded the founder in 2010 after his suicide, would be leaving following the spring 2024 fashion show, and after working 26 years in total at the London-based house.

To replace her, Kering continued its practice of picking an under-the-radar talent, entrusting Dublin-born Sean McGirr — most recently head of menswear at JW Anderson — to take up the creative helm.

Analysts are keenly watching for new signs of life at Gucci, the linchpin brand of the group, whose momentum under Michele began sputtering in recent years.

In a research note last month, HSBC flagged another misstep.

“Gucci is still suffering from decisions taken during the pandemic to protect margins and cash flow generation instead of investing in marketing to fuel growth as other key competitors in the luxury sector did,” HSBC said, reasoning that Kering may have adopted this “protective measure in particularly challenging times” because of its roots as a retail company prior to its transformation to a luxury group. “This mentality could be penalizing the group’s performance today.”

HSBC noted, however, that “looking at past examples, we know that a brand turnaround usually takes 12 to 18 months.”

Analysts at TD Cowen see green shoots: “It’s early, but we do like the new creative direction at Gucci with a good focus on timelessness, compelling valuation, and long-term opportunity in beauty,” the analysts said after Kering reported disappointing results in the third quarter.

The bank also noted Kering’s “agility on brand and product innovation to create iconic leadership from a fashion perspective as the legacy luxury houses reinforce modern and young style characteristics.” It rates Kering as “outperform based on the company’s scale within the luxury sector.”

Best of WWD