Retail Tech Investments Hit Another High in Second Quarter

The latest State of Retail Tech Q2’21 Report from CB Insights is eye-opening as researchers at the firm noted investments in retail technology hit another record in the second quarter. The authors of the report said funding jumped 4 percent quarter to quarter, climbing to $31.5 billion — which is more than triple the investments made in the same period last year.

The analysis of the numbers concludes that the ongoing burst of funding in retail tech is due to “solving near- and long-term challenges.”

More from WWD

“Immediate issues like the labor shortage are intensifying the need for automation, from store shelf tracking to self-driving delivery trucks,” the researchers said. “Meanwhile, big tech companies and start-ups alike are pushing ahead with tech to enhance mobile shopping. In the longer term, the potential for tech like blockchain to transform the supply chain, customer loyalty and product development is growing.”

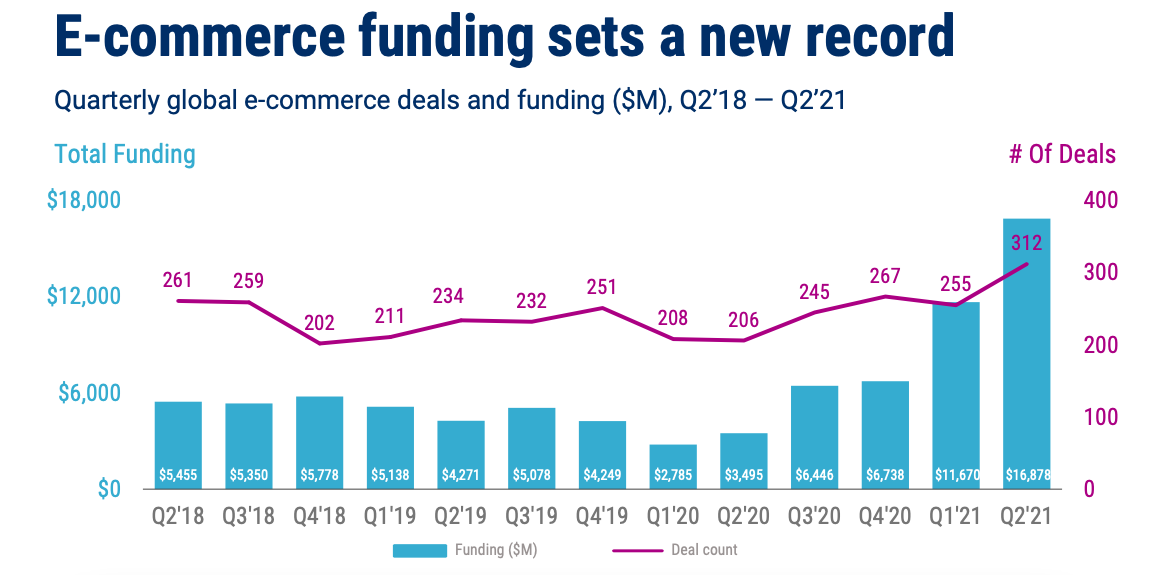

Another factor for the large investments and valuations is that the pace of e-commerce growth isn’t slowing down. “The five highest-valued new retail unicorns in Q2’21 span the e-commerce value chain, from online behavior tracking to payments tech to delivery,” the report noted. “Meanwhile, the top five mega-rounds [deals worth over $100 million] in the space all went to e-commerce companies. Food and grocery delivery companies remain major investment targets.”

Simultaneously, a crowded, heavily invested retail tech market is also “ripe for consolidation,” CB Insights said, stating that “notable mergers and acquisitions in Q2’21 were concentrated in e-commerce enablement and operations.”

Looking at specific trends behind the numbers, CB Insights said as shoppers return to physical stores, the demand for technology tools and solutions that streamline store operations and foster smoother and more personalized shopping experiences for consumers is rising.

“Funding to in-store retail tech reached a record $3.3 billion in Q2’21, a jump of 46 percent quarter-over-quarter,” the report noted. “Tech that automates shelf tracking will free up associates to spend more time with customers. Clienteling platforms can then help employees further personalize the shopping experience.”

Companies cited in the report include Abeja for customer tracking, Mediar for shopper and category performance insights, and One Door for visual merchandising. For clienteling and personalization, CB Insights spotlighted Mercaux, Salesfloor and Tulip.

Another growth area within personalization is the mobile shopping app space. Companies showcased in the report that offer “conversational commerce” and chat commerce, as well as Shopify-integrated mobile commerce technology, include Charles, Yalo, TapCart and Via.

Sign up for WWD's Newsletter. For the latest news, follow us on Twitter, Facebook, and Instagram.