Fashion Stocks Seek Redemption After Wall Street Fallout

Wall Street has always been a roller coaster — but the ups and downs have all become supersized, leaving fashion to barrel into 2023 with more than a little stock market whiplash.

Investors are ceaselessly gauging the prospects of everything, taking in the economy, the consumer, new products, strategy and performance and boiling it down to a single data point — the all-important stock price.

More from WWD

And while ups and downs are expected as individual companies and sectors surge ahead or as the economy cools, something more is going on.

The investment crowd fundamentally reset expectations for the consumer sector in 2022 as e-commerce growth slowed, inflation and interest rates skyrocketed and recession loomed. Last year also had its optical challenges and the quarterly financial reports often paled in comparison with the go-go days of 2021, when the world was first reemerging from COVID-19.

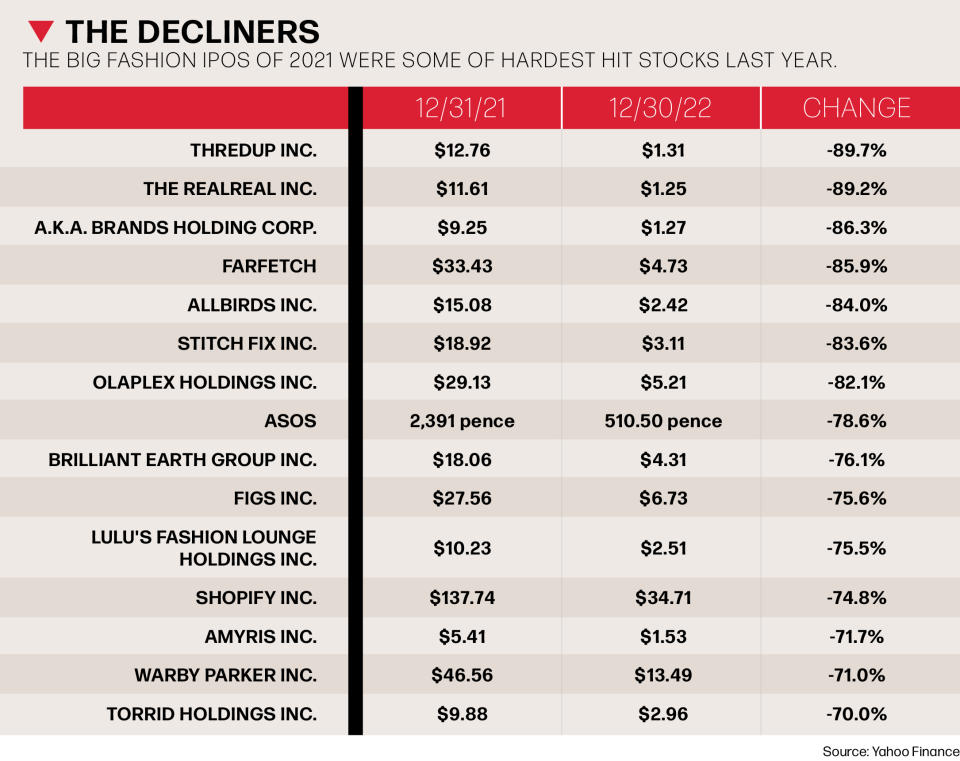

The Dow Jones Industrial Average dropped 8.8 percent in 2022, but fashion fell further and faster.

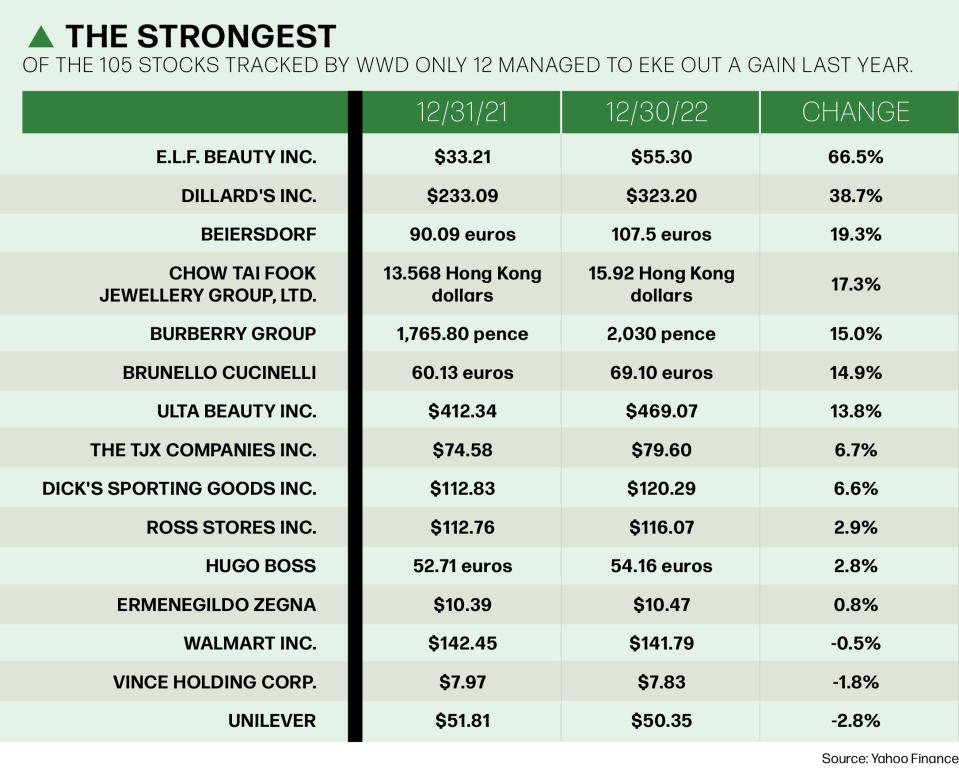

A WWD study of 104 global apparel, luxury, retail and beauty companies found that only 26 firms in the space beat the Dow last year. (E.l.f. Beauty Inc. led the way, rising 66.5 percent, while middle America department store standby Dillard’s Inc. gained 38.7 percent).

Luxury also held onto its pandemic gains and continued to power through even the economic worries, but 2022 was a year defined by the decliners.

Among those getting hit the hardest were some of the buzziest names of yesteryear that were either new to Wall Street or pushing newer business models that investors are still trying to get their heads around.

Companies losing more than 70 percent of their value last year included resale specialist ThredUp Inc., brand house A.k.a Brands Holding Corp., sneaker-maker to the tech crowd Allbirds, social media-focused beauty company Olaplex Holdings Inc. and direct-to-consumer eyewear pioneer Warby Parker Inc.

That counts as a rude awakening for the great 2021 wave of IPOs and leaves the position of some of the newcomers in doubt.

“Darlings fall quickly and the first step’s a doozy,” said Matthew Katz, managing partner at SSA & Co.

That reflects the flight of investors from the buzzy new idea to the more tried and true business model — and it seems likely that investors will continue to seek out safety.

“We’re in a period of uncertainty,” Katz said. “And some would say it’s become more and more certain that there’s trouble ahead.”

So companies still working on their operations might get caught in the squeeze.

“Where there’s unfinished business, inefficiencies are going to get magnified in a period of slowdown,” Katz said.

Resale platforms, for instance, caught the imagination of investors quickly, but now have to prove themselves as more brands get into the game and the sector evolves.

Poshmark Inc., which was valued at more than $7.4 billion after it went public in January 2021, took a $1.2 billion buyout from Naver in October and shares of both The RealReal Inc. and ThredUp are struggling.

Jessica Ramírez, senior research analyst at Jane Hali & Associates, said, “When we look to resale … we were also very surprised how quickly Wall Street adapted to it, which we almost thought didn’t make sense. It usually takes [Wall Street] longer to warm up to some of these ideas.”

Turns out, investors were quick to fall in love in 2021 and quick to move on.

Many companies that had been building in private hands failed to live up to the public market’s big expectations.

Ramírez said the brand “has a glass ceiling to the excitement it can cause and the stir it can cause.”

The brand is in step, even leading in the sustainability movement, but is still finding its footing.

“There’s a good cause to it, but the shoe isn’t attractive,” Ramírez said. “You need to have good product that’s attractive and have a good story behind that.”

It’s steady businesses and proven models that are winning on Wall Street today, like offpricers Ross Stores Inc. and The TJX Cos. Inc., which have been feasting on the industry’s excess inventory after all the COVID-19 supply chain backups.

“Ross and TJX have really taken advantage of what’s out there to buy and have killed it with their buys,” Ramírez said.

Dick’s Sporting Goods Inc. has also proven its mettle.

“Product has really taken off there — private label and the relationships that they’re building with all their vendors have really increased,” said Ramírez, noting the retailer is also taking advantage of the continuing rise in outdoor activities. “They’re very much in tune and they’re running a pretty good business.”

Dick’s, TJX and Ross not only beat the market, but posted modest stock gains last year — a time when small gains counted as big wins.

Much of the trouble over the past year came from changes in the consumer market that were bigger than any one brand.

Lower-end shoppers started having to choose between fashion and food as prices rose. More consumers went back to stores, slowing e-commerce growth. And Russian president Vladimir Putin’s invasion of Ukraine upended the geopolitical calculus, threatened Europe and prompted many companies to close up shop in the once-promising Russian market.

It might take similarly broad changes to help turn retail back around this year — but in the second half, when comparisons ease again.

John Kernan, an analyst at Cowen, said supply chain cost deflation and more normal inventory levels would drive sentiment in the second half.

“We favor cheap stocks vs. history given the several hundred basis points of gross margin relief from lower ocean container rates and air freight along with the normalization of sector inventory levels and markdowns into the second half,” Kernan said. “Balancing supply chain risk, inventory turn and gross margin is a source of value creation in the sector.”

That is a very back-to-basics path back to Wall Street success after a very rocky year for fashion.