I've Always Wondered How Travel Insurance Works And If Its Worth It — This Is What An Expert Had To Say

I've pretty much dedicated the last six years of my life to travel, and I've never bought travel insurance. I've always seen it as an added (and unnecessary) expense.

CBC / Via Giphy / giphy.com

I like to travel for cheap, so I'm all about cutting corners where I can — and travel insurance has always been one of those corners for me.

But as I've cautiously started traveling again, the realities of COVID-19 have me rethinking things.

Comedy Central / Via Giphy / giphy.com

Even though I waited to travel until I was vaccinated (and still wear a mask when I'm around people), I feel the added stress of COVID-19 in my decision making. In addition to worrying about keeping myself and others safe, there's a financial risk.

If I were to test positive for COVID-19 before a flight out of Paris, I'd have to cancel my flight and cover the costs of my quarantine. That translates to around 140 Euros a night for 10+ nights, plus the cost of rebooking your flight and ordering in food and groceries. That's at least an additional $2,000, and probably much more.

So I picked the brain of someone who's in the travel insurance biz to see if buying a policy is actually worth it.

NBC / Via Giphy / giphy.com

Sasha Gainullin, a travel insurance expert and the CEO of battleface, a travel insurance company, answered all my questions so that you (and I) could decide for ourselves if buying travel insurance is worth the cost.

1.Travel insurance usually covers the cost of your trip and any unforeseen hassles or expenses.

Fox / Via Giphy / giphy.com

Of course, everything is dependent on the type of travel insurance you've bought (and from who), but in theory, if you've paid $600 for a nonrefundable plane ticket and $1,250 for a nonrefundable lodging deposit, your travel insurance should cover those costs and refund you if your trip is cancelled or interrupted.

"Travel insurance typically covers basic needs. For example, it can cover your financial investment toward the trip in case of cancellation or interruption," explained Gainullin.

In addition, it usually covers unforeseen expenses that come up — like if your trip is delayed, you lose a bag, or have a medical emergency.

2.But ..."foreseen expenses" aren't always covered.

NBC / Via Giphy / giphy.com

The distinction between unforeseen and foreseen can be tricky. To add some clarity, Gainullin says, "I remember working with travelers who showed up at the airport with an expired passport, and their travel insurance policy didn’t provide coverage for this situation. Simply put, this scenario is foreseen and preventable."

So while a hurricane might be viewed as unforeseen, once the storm has been named and confirmed to be coming, it might become a foreseeable event. If you bought travel insurance before anyone was aware of the hurricane, it would be a covered, unforeseen expense, BUT if you bought travel insurance after the storm was confirmed and named, it might not be covered.

Phew.

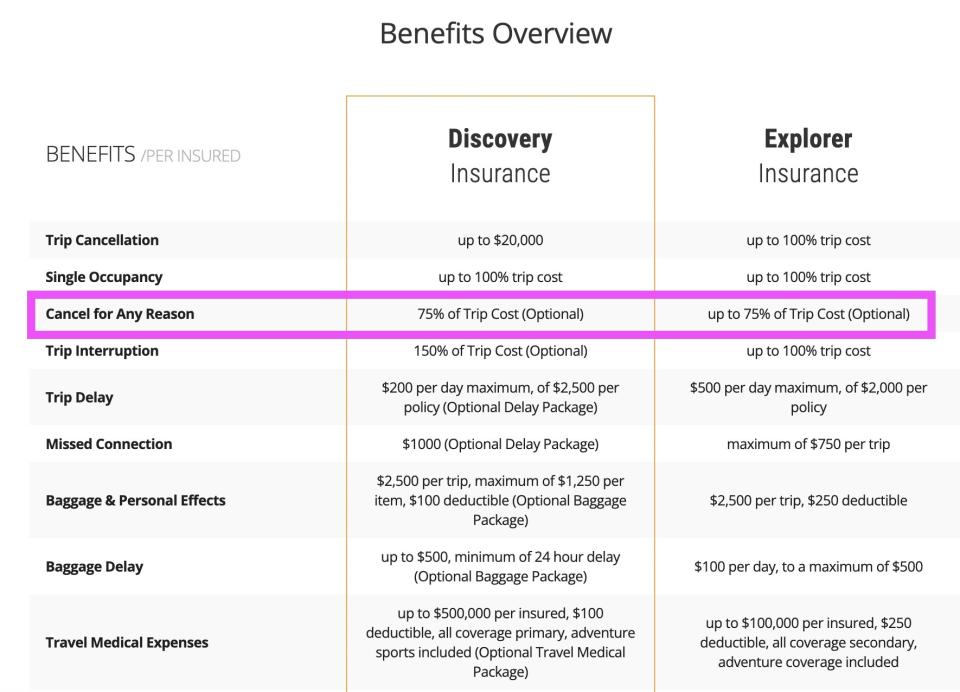

3.If this is all a little too wishy-washy and you want everything (or almost everything) covered, you should probably just buy the "cancel for any reason" add-on.

The answer to that murky unforeseen-foreseen line is “cancel for any reason” coverage (usually an add-on or upgrade).

“'Cancel for any reason' is a great add-on if you wouldn’t want limitations. If you opt for 'cancel for any reason,' it’s important you understand any limits on the actual reimbursement amount," explained Gainullin. "For example, at battleface, 'Cancel for Any Reason' refunds up to 75% of your prepaid trip cost."

For context, I also looked into AIG Travel Guard, which has "cancel for any reason" coverage available as an add-on to their higher-tiered plans. The add-on would have cost me just under $35 and would cover up to 50% of the prepaid trip cost.

4.If you're worried about COVID-19, keep in mind that the pandemic is often categorized as "foreseen."

MTV / Via Giphy / giphy.com

If you're worried about contracting COVID-19 while traveling and being forced to change your ticket and book a quarantine hotel, listen up: Gainullin says you should "look for products that specifically provide coverage for COVID-19, including for medical or quarantine expenses if you need to receive treatment while traveling. There could be an exclusion based on destination if government travel warnings are issued."

If this is a concern for you, you should look into that "cancel for any reason" benefit or choose a policy that treats COVID-19 like any other illness (which is battleface's policy).

5.If something goes wrong before your trip, your travel insurance should refund you for what was prepaid and nonrefundable.

Fox / Via Giphy / giphy.com

If you have to cancel your trip, chances are there will be a mix of refundable and nonrefundable costs. For example, if you booked a Basic Economy fare through United, the airline is not likely to refund you, so that would be a nonrefundable cost that you would run through your travel insurance. The same goes for your lodging. Part of your Airbnb deposit may be refundable, but depending on how late you cancel, you may lose the deposit. Covering that nonrefundable deposit is where your travel insurance policy comes in.

"Usually, travel insurance companies refund back what was prepaid and non-refundable," explains Gainullin.

6.Just keep in mind that the refund process could take up to 14 days.

Lifetime / Via Giphy / giphy.com

Waiting a couple weeks for a refund is better than no refund at all, but the delay can depend on the type of claim you make and the company you bought your policy through.

"Always check with the insurance company directly because this information should be easily available before you purchase your policy," says Gainullin. "Some expenses could be reimbursed instantly, and some require up to 14 days to process."

7.If something goes wrong while you're traveling, call your travel insurance provider before you pay anything — they might handle payment upfront (rather than reimbursing you after the fact).

ABC / Via Giphy / giphy.com

Again, it depends on the company, but when something goes wrong Gainullin says you should "connect with your insurance company right away because many expenses, such as medical or transportation back home, can be prepaid and arranged by the company."

8.Travel insurance typically costs around $120.

NBC / Via Giphy / giphy.com

Gainullin estimates that travel insurance costs "roughly about $120 per person, where pricing is based on your age, trip costs, and the type of travel you're booking."

According to reporting by Business Insider (who gave a mid-2020 travel insurance cost of $111 on average), the more expensive a trip, the more expensive it will be to insure. And if you're over the age of 40, you may have to pay more.

9.And around 30 percent of people who purchase it end up using it.

CBS / Via Giphy / giphy.com

One of my hesitations with buying travel insurance is the belief that "everything will work out fine," and I'll never use it. I was surprised when Gainullin shared, "In relation to filing a claim, it’s roughly 30%," meaning that 30% of people who buy travel insurance file some sort of claim or use the policy they bought.

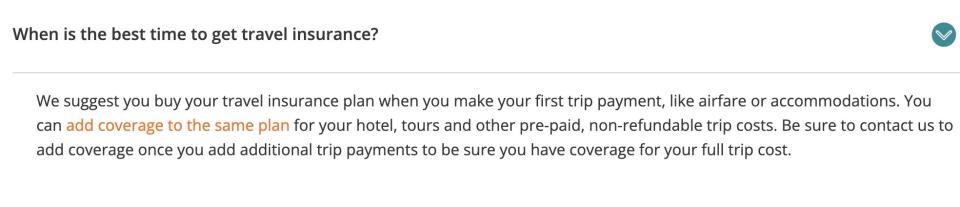

10.The best time to buy travel insurance is right after you start confirming and paying for your trip.

I've always wondered when you're supposed to buy travel insurance — before you book stuff, right after, or anytime after? It turns out timing does matter. A policy typically kicks in the day after you buy it, so you would be covered for events that happen after that date. However, it's not retroactive, so if you wait to buy it after you break your leg or hear about a big storm, it may be too late.

To sum it up, Gainullin says, "We recommend booking travel insurance as soon as you start pre-paying for your expenses."

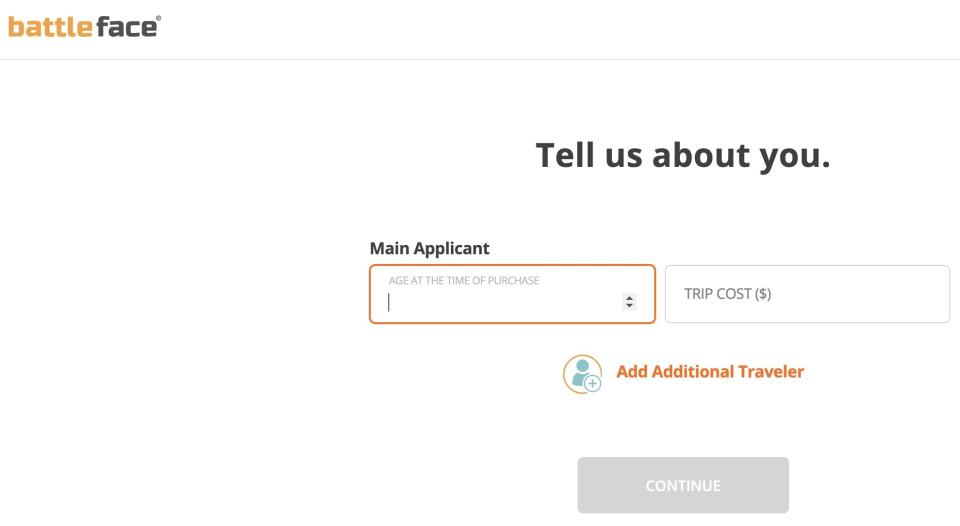

11.Buying a policy should be easy.

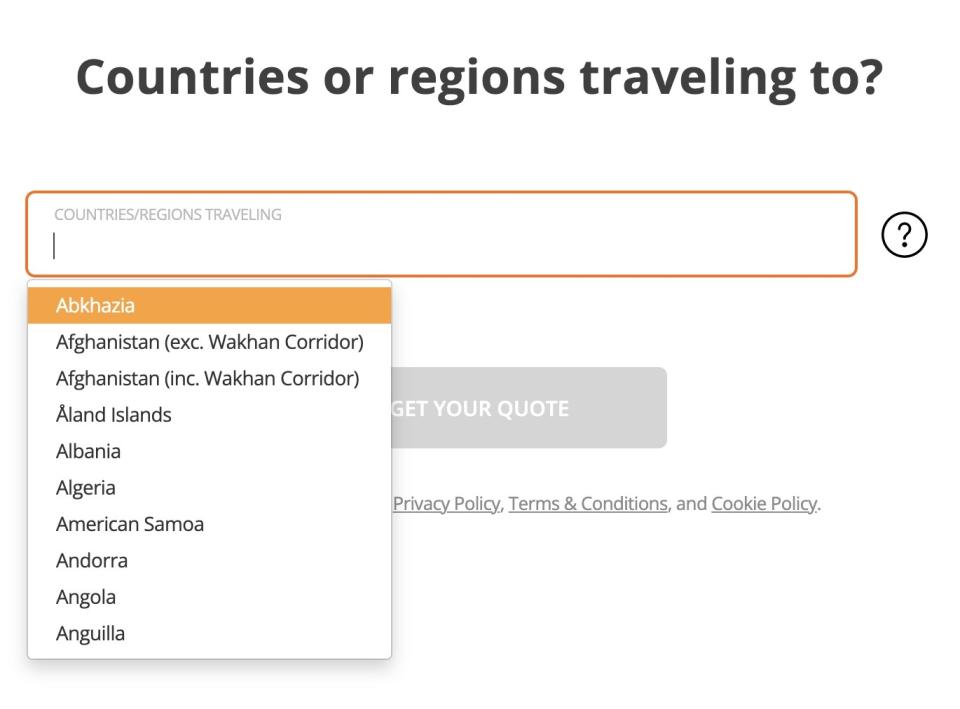

The process of buying travel insurance can vary based on what company you're buying from and where the policy is purchased, but Gainullin says the process is simple at battleface.

"To get a quote, you just plug in your state, age, total cost of your trip, dates of travel, and destination. From there, you’ll review the options. You can pick a package plan or create your own. It’s that simple. You should be able to purchase your policy in less than two minutes without having to answer unnecessary questions."

12.Don't assume that your medical insurance (or health coverage) will cover you while you're traveling.

Bounce / Via Giphy / giphy.com

There are always exceptions (do your research!), but your health plan will often have limited or no coverage in other countries. Plus, in addition to covering bodily injury or evacuation, travel insurance also covers things like lost baggage and trip delay.

"Interestingly, a study we conducted with Opinium found that 20% of Americans believe their primary medical insurance can cover their travel mishaps, but medical insurance often doesn’t provide the same coverage as travel insurance," explained Gainullin.

13.And don't assume that credit card insurance will cover you.

CTV / Via Giphy / giphy.com

I'm definitely guilty of this belief. I always assumed that if I paid for a trip on my credit card and something went wrong, one of the card's benefits would cover me. While that can be true to an extent, Gainullin noted that when it comes to credit card insurance, "Many offered products would have low limits and tons of exclusions or worse — no insurance benefits at all, just services."

14.You should also be wary of the travel insurance policies that airlines push at you when you're booking your flight.

Anytime I'm about to confirm a flight, a little box appears asking if I want to purchase travel insurance. At first glance, it seems like booking travel insurance through an airline (which you hopefully trust to an extent) would be a smart move.

Not so much.

Like credit card insurance, Gainullin says that a lot of those airline-sponsored travel insurance policies have "low limits" and are "exclusion-driven products," meaning the coverage sucks — even though it might be cheap.

"Unfortunately, at present, airline insurance plans are designed to benefit the airline and not the passenger, and they offer the same package plans to all travelers without considering the traveler’s flight plans or needs. ... Also, these plans are limited in what they can cover," he says.

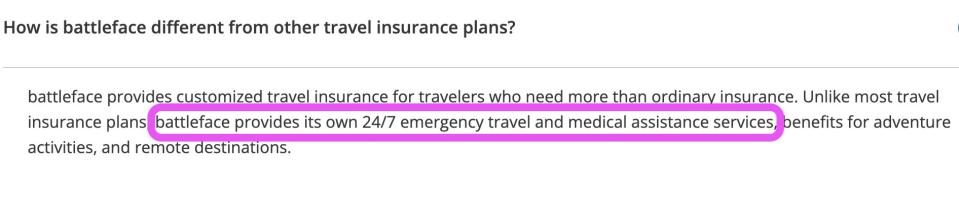

15.Even if travel insurance saves you in the end, there are a few things that can make it a pain to deal with.

Things like bad customer service, hidden fees, and complicated claims processes can make a service that's supposed to help you feel more like a hindrance.

Gainullin says travel insurance can get complicated "when services aren’t centralized through a single company," noting, "Many companies that sell travel insurance don’t handle their own systems, product creation, claims, or emergency travel assistance services."

His advice? "I’d only recommend a company that is responsible for their own products, services, and can respond to customer emergencies 24/7."

16.Your policy should always be tailored to you and your trip.

If you're flying to Mozambique for a month-long expedition, your travel insurance should look different than what you might buy to visit your mom in Milwaukee.

Every company does it differently, but at battleface, Gainullin explains, "We start with a base coverage for trip cancellation, and customers can then add benefits that are relevant to their needs. Making sure you have enough coverage for medical and evacuation expenses is important, especially for international travel."

17.Travel insurance is really more of a must on big, expensive trips. But it all depends on your comfort level.

Red Granite Pictures / Via Giphy / giphy.com

Plenty of quick domestic trips end in disaster — ski accidents, hurricanes — but as a general rule, the more you pay for a trip, the more you have to lose.

With that in mind, Gainullin suggests "purchasing insurance for international trips, extended visits, and trips that are higher in cost. This helps you avoid fees and financial losses, especially when it’s a trip you’ve been saving months or years for."

You need to be honest about how much money you're willing to lose and buy (or not buy) travel insurance accordingly.

18.No matter what you decide, don't pay for a travel insurance policy before you understand what benefits (and what exclusions) you're signing up for.

"Before embarking on a trip, do your research, ask questions, and don’t stop until you really understand your policy and benefits you are buying into," says Gainullin.

It's a complicated process, but once you do the legwork, you can apply what you learned to future trips.

Tip: It may help you in the long run if you take a day to understand your current medical insurance coverage and any travel coverage your credit cards offer.

NBC / Via Giphy / giphy.com

Before you buy travel insurance, take a day (or even an afternoon) to dig through that super-wordy health insurance guide you likely have stashed somewhere. Does your medical insurance work in other states? What about internationally? In what destinations are you fully or partially covered?

Then, research your credit cards to see what is and isn't covered in regard to trip reimbursement, baggage loss, travel delays, etc. No matter what, keep in mind that you probably won't be dealing with your credit card company if something goes wrong and will have to reach out to a third party to sort everything out.

What's been your experience with travel insurance? Have any tips to share?

And for more money tips and tricks, check out the rest of our personal finance posts.

Solve the daily Crossword