Has Covid-19 Changed Fashion Buying for Good?

Travel restrictions have helped modernize the fashion wholesale system in permanent ways, and spelled success for digital buying tools.

Big funding announcements have slowed down over the past 12 months, especially in the fashion space — understandably. Gone are the days when it felt like some e-commerce startup was announcing a multimillion-dollar round every week. The few companies that have received large injections of cash since March of 2020, though, are worth looking at.

First off, they're all digital. And they include StockX, Rent the Runway, Fashionphile, Vestiaire Collective and, most recently, Nuorder.

Despite not being particularly well-known outside of the industry, that last one just announced that it raised $45 million to expand its B2B digital buying platform, in a round co-led by Natalie Massenet's Imaginary Ventures. Massenet, who also founded Net-a-Porter, will join Nuorder as a board member and strategic partner, helping the company drive European growth, as well as expand further into fashion and luxury.

"I have seen firsthand how slowly the fashion and retail industry adapts to change without a tipping point, and this past year has been another critical inflection point for many," she said, in a statement. "There has been much focus over the last few decades on the consumer end of retail, but little advancement in the ways the industry operates behind the scenes."

That's starting to change.

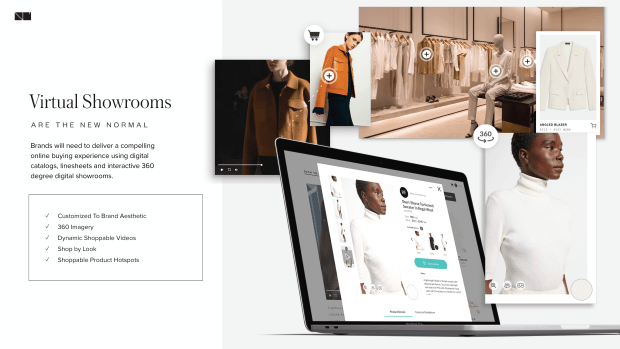

In the mid-to-late aughts, Fashion GPS revolutionized the way publicists and press interface by offering digital sample trafficking and managing fashion-show and party RSVPs. Before Nuorder, Joor was arguably the most commonly used digital platform for buying and selling fashion. Now, both offer a slew of features to brands and retailers, including "virtual showrooms" to mimic the IRL-showroom visit experience. And both have seen massive growth over the past year.

Nuorder — which counts Saks Fifth Avenue, Nordstrom and Bloomingdale's as exclusive users of its platform — saw 125% growth driven by the effects of the pandemic, a 224% increase in users of its Retail Assortments Platform and a 87% increase in the number of orders placed by retailers.

Meanwhile, Joor has seen a 44% increase in the number of retailers using its platform and a 412% increase in visits to brands' virtual showrooms in the back half of 2020 specifically. (Also, it has raised $36.1 million as of 2019.) In February of 2021, it saw a 106% increase in wholesale transactions as compared to February 2020.

Joor's 30+ exclusive retail partners include Shopbop and East Dane, and its virtual trade show platform, Joor Passport, become a go-to for trade event organizers looking to take their previously IRL experiences digital amid the pandemic. It hosted 16 events during the Fall 2021 season alone, and 17 in 2020; London Fashion Week, Cabana, Rakuten Fashion Week Tokyo and Liberty Fairs were among its partners.

Joor and Nuorder may be direct competitors, but they both believe they represent a fundamental shift in the fashion wholesale process, which, being reliant on physical paper forms and Excel, has long been seen as archaic, inefficient and in need of some streamlining — or, in startup speak, ripe for disruption.

For an industry that prides itself on creativity and innovation, fashion is notoriously slow to change the way it operates or adopt new technology. (Think about how long it took for many luxury brands to launch e-commerce.) The founders of Joor and Nuorder see a similar revolution finally taking place with fashion wholesale.

"[E-commerce] was something people were skeptical about and now it's a critical part of someone's business; we see that transformation happening with B2B as well," says Nuorder co-founder Olivia Skuza.

In an e-mail to Fashionista, Joor CEO Kristin Savilia echoes the sentiment, noting that the company's "growth in the past year proves that digital is critical to the success of B2B commerce as well as B2C commerce."

Related Articles

What the Buyers Are Buying from the Fall 2021 Runways

A Look at How the Fashion Calendar Has Evolved From 1941 to Now

Has Gucci Rendered the Traditional Fashion Show Obsolete?

Skuza and her co-founder, Heath Wells, estimate that, without the pandemic, the level of adoption they're seeing now would have taken a couple more years. Of course, there are some reasons for that beyond the fashion establishment's stubbornness in the face of change.

For one, fashion is a tactile industry, and buyers like to touch and feel what they're going to stock in their stores, argues Sharifa Murdock, owner of the trade show Liberty Fairs. Speaking with other luxury fashion buyers, it seems this has been the main pain point during this past year of digital buying.

"The in-person showroom experience is important to understand the overall collection, see and feel the individual garments, and merchandise the product offering in real time," says Anna Irving, SVP, GMM of Women's Designer Ready-to-Wear at Saks Fifth Avenue, who uses Nuorder. "It is very difficult to see the drape in a dress, the sheerness of a fabric or the print on a top on Zoom."

Tiffany Hsu, MyTheresa's Fashion Buying Director, notes how, if someone's internet connection is lacking, the whole thing becomes even more difficult: "Some showrooms have terrible WiFi, which is a disadvantage to really see the items properly."

There's also something about meeting with people in person that can't quite be replicated online. "A good chunk of the job is networking, especially while on market, which has greatly been affected in the last year," explains Brigitte Chartrand, VP of Womenswear Buying at Ssense. "We miss the in-person element to our relationships with vendors."

Laura Vinroot Poole, the owner of Charlotte, NC and Los Angeles-based boutique Capitol, struggles the most with Zoom fatigue and the fact that there's not one standard way for brands to take orders. "Everyone will have a different method," she says. "It's been really clear, nobody knows what they're doing."

Of course, Vinroot Poole and her colleagues are understanding of the fact that the past year has been difficult for everyone. She's been able to find ways to make digital appointments work to her and her team's advantage by requesting that they send images beforehand, for example, and only having them pull the items they want to see, "so time is well-spent."

Irving concurs that, in some ways, "this technology allows us to be much more efficient regarding the number of appointments we attend." Chartrand echoes this, adding that, in her experience, this shift to digital has "increased our productivity and allowed us to work on new creative projects, such as category extensions — like our recently launched Everything Else department — and discovering new talent."

Technology has also spurred a shift in wholesale timelines. The ability to see new collections and write orders digitally supports the idea of an always-on buying season, where buyers and brands alike aren't beholden to specific seasons or market weeks. Irving notes that this has allowed Saks to be "much more nimble with picking up new brands and capsule collections as they develop."

In general, buyers have described being more flexible with how they work with brands, especially smaller, independent ones who may have been under extra pressure this past year.

"For new and smaller brands, we might work on new terms whereby we are trying to support them with taking some excess stock," says Hsu. "We're in this together so we want to make sure our suppliers are supported."

Likewise, Vinroot Poole says she's noticed "a lot more graciousness and thankfulness" on the part of independent brands and designers in particular.

Even though brands and retailers are getting better at finding ways to work around and make the best of digital limitations, Murdock shares that many are eager to get back to doing things in person. She and her team are already planning an IRL trade show for Summer 2021 in Miami.

But does that mean everyone's going to cancel their Joor and Nuorder memberships as soon as the borders open up for travel? Is that $45 million about to go down the drain? Probably not.

Even before the pandemic hit, buyers and brands were questioning the need to constantly present new collections and constantly travel to see them. This past year has further woken people up to the fact that what everyone was doing before was...a little much.

"We used to travel all over for things we felt we needed to do. It's put everything into perspective," notes Murdock. "Companies are going to shorten travel budgets because we didn't travel for a year and business still continued."

It's not just about the expense: For people like Vinroot Poole, who does all the buying for her small business, traveling eight times a year and attending 8 to 10 market appointments a day in various time zones was simply unsustainable, and something she can't imagine going back to. Digital buying allows her to have more control over life, she says — "being able to say, 'I am coming this season, not this season.'"

The future of fashion buying will include a mix of travel (perhaps four times a year instead of eight) and reliance on digital tools, that hopefully results in more manageable schedules for all.

"There will be more attention placed on streamlining the fashion calendar and market schedule to make the buying process more efficient," Irving predicts. "I don't think we will ever go 'back to normal.' We will certainly use technology more often, whether it be for a product knowledge seminar for top shoppers across the country, or for quick check-ins with brands on their merchandise in development."

Meanwhile, the people behind this technology are busy coming up with new features to provide added value for its users post-pandemic: Joor and Nuorder recently launched payment functions; soon, Nuorder will debut a new financing feature alongside a credit partner.

"Everyone's in a cash crunch; retailers need more time to pay and brands need the money faster than ever to support production so they can produce the goods and ship it to the retailer," explains Skuza, pointing out that this new feature will give retailers more time to pay while the brands still get their funds immediately.

Joor and Nuorder also see data as a major benefit to retailers. Wells posits that Nuorder can help them buy more efficiently by identifying gaps or redundancies in their assortments.

"Being able to use technology not just as efficiency but actually unlocking more value is really where this is headed," he says.

Never miss the latest fashion industry news. Sign up for the Fashionista daily newsletter.