China’s Streetwear Whisperer: Peter Zhong

SHANGHAI — It used to be that streetwear fanatics in China relied on Yoho and Hypebeast as their go-to sources for everything in the subculture. Hypebeast, with its more international slant, could be counted on for the latest exclusives on global releases, especially Supreme news, while Yoho was the domestic king. The hot start-up picked up private equity funding and expanded its empire quickly in just a few years, touching everything from magazines, offline stores and the business-to-consumer fair and trade show Yohood.

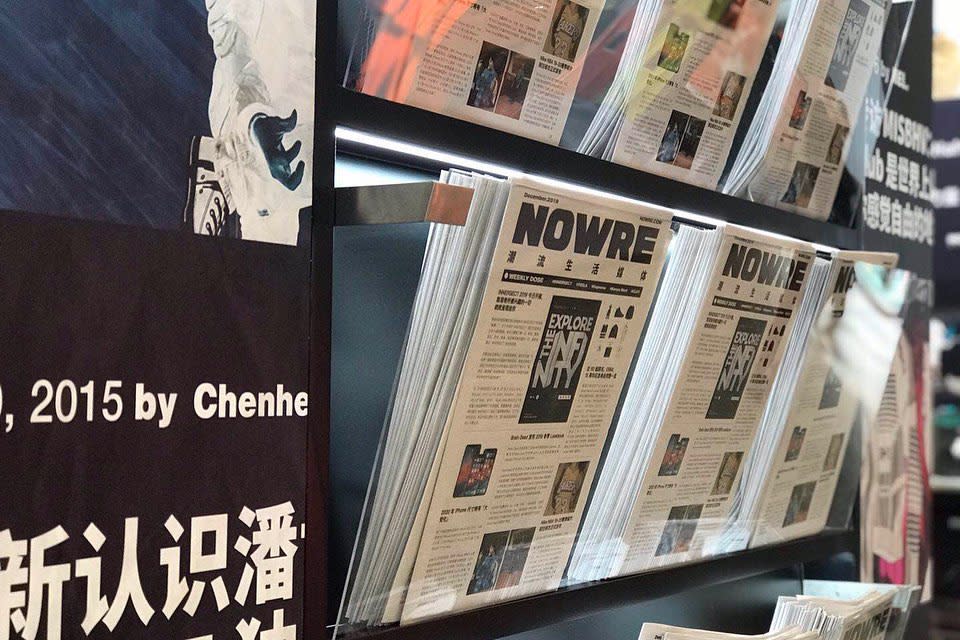

But soon after the pandemic hit, Yoho ran into cash troubles. Forced to abandon many of its projects, the company has been on life support for some time. Since then, Nowre, another street- and youth-culture-focused platform, has been amassing clout and fans to the tune of three million followers and counting.

More from WWD

Here, Nowre’s co-founder, Peter Zhong talks with WWD about how the company got started and how his team, which has expanded from just editorial to a full digital agency, sees the future of China’s streetwear movement.

WWD: What is Nowre?

Peter Zhong: It stands for “now” the present and “re” the past. We want to cover all past and present of youth culture in China with a global vision. In 2014, there were not many online media outlets in mainland China focusing on street or youth culture, compared to other markets like Taiwan or Japan, for example. We saw an opportunity to start this platform with my partner Chris Wang. I have a background with sports brands from Nike and Converse in retail and marketing. Chris’ background is advertising. He was with Wieden + Kennedy and was one of the earliest founding employees of Yoho, and also still has his own advertising agency, Horizon.

WWD: Who is your reader? What are some regional differences you see across the country?

P.Z.: We get 50 percent of our readership from tier-one cities, but there’s a big growth of readership in western cities Chengdu, Chongqing and Xian. The youth culture is getting stronger and stronger in western China. Economies are growing and the youth has the urge to express themselves more.

Cantonese culture will always be the leading force for youth culture because of the influence of Hong Kong from the early days. Any street-culture media or youth media in China, the readership from Guangdong should contribute as the top province because unlike other provinces they have two tier-one cities, Shenzhen and Guangzhou.

In terms of gender, it’s 60 percent male and 40 percent female as we started NowHer two years ago.

Courtesy

Courtesy

WWD: How large is the company now and how did you expand from media outlet to other businesses?

P.Z.: We have 60 employees full-time, we’re fully independent. We do content creation and a media platform. Then, because of how many times we talked to different brands, they reached out to us for consumer insights or industry reports and we slowly grew that into production work. So it’s similar to the Hypebeast and Hypemaker business model.

We started to help on strategy, then slowly we got more digital agency work and when the brands are ready to go to market, we developed a PR service, doing some seeding, cross-media buys in the streetwear sector. Last but not least, we help brands do events. Since the brands firmly believe that consumer insights are the key for their strategy, we slowly became a full-service agency. But we understand that we can only do branding digitally to a certain degree, where a lot of experience needs to be done offline. Hence we have developed a few offline programs like Nowre marketplace and pop-up spaces to participate in important offline culture moments.

WWD: What is the streetwear media competitive landscape like?

P.Z.: We see a lot of bloggers and influencers doing their own thing. But for Nowre, we always knew what we wanted to do from Day One. We want to become the local media destination platform for the culture. That’s the key distinction between us and media like Hypebeast. They’re based in Hong Kong, but people don’t realize they’re from Hong Kong. I didn’t see a lot of Hong Kong influence for Hypebeast or Chinese influence for Hypebeast, until they launched their China site. For Nowre, we focus on local content contributing at least 60 and 40 percent international content.

WWD: It’s been nearly a year since the Better Cotton Initiative controversy over Xinjiang cotton. What kind of long-term impact do you think it had on Nike and Adidas? What advice do you have for brands concerned about getting caught in the political crossfires?

P.Z.: The challenge for international brands are many but political events are short term. At the end of the day, it is about serving the consumer, I think that’s the key.

Nike and Adidas definitely saw a pullback in sales, but it’s also a long time coming. Chinese brands like Li Ning and Anta have been investing for years. The incident disrupted the market so the competitors, the Chinese brands and the consumer mindset can switch but local brands have steadily been getting stronger.

There are many, many factors. I don’t think that BCI is the main reason for local brands catching up. In certain categories, they have more advanced supply chains than the international brands. You can turn around a product fast, which gives you a huge advantage, you can have more drops. You can innovate a lot faster and they’re not scared to take risks. In terms of scale, they are still smaller than the international brands, but [there are so many] decisions multinationals have to go through globally. They are reacting to Chinese brands, instead of leading the way on how they want to fight the fight, and that gives Chinese brands a lot of advantage. For Chinese brands, they are on the ground, they have the supply chain here. They have the marketing team here and speak the same language. Brands here evolve a lot faster. To name a few: Random Event, Rolling Wild, or Bosie.

The main logic in our parents’ generation was that everything overseas is better. We [as Millennials] still have this mentality that overseas is better. But kids who are born after the 2000s, the Gen Z, when they were born, China was already in a way better place. Their mentality and thinking is China is as good as anywhere else, the nationalism is really building up. By the time they were in their twenties, they were willing to support local Chinese brands.

Courtesy

WWD: So what can international brands bring to the table?

P.Z.: Their advantage is still very clear in that China doesn’t have these subcultures to begin with. Everything came from overseas. I think the streetwear brands that have done well in China started early and they kind of own certain communities. Because they have invested in this community, it’s the authenticity. Vans or Nike, they have the resources to become the main sponsor for every major event in their categories or pillars.

WWD: How concerned should brands be about the recent scrutiny on celebrities and “idol worship”?

P.Z.: I think brands have started to notice there are risks to relying heavily on celebrities. It’s a double-edged sword. But I don’t think it reflects the street culture. We can’t be cynical and apply all western values onto the Chinese government, when the fact is most western-format products have prospered and are growing, instead of being targeted here.

WWD: What are some interesting insights you’ve observed about the way men in China spend that brands should know?

P.Z.: Males in China consume to show their identity. Sometime it’s a flex or about making a statement. Chinese men are also very known for being generous to their girlfriend or other half.

Then high-end performance gear with less obvious branding has also been very popular among high-income men, for example in outdoor camping gear and golf equipment.

WWD: What is a common point of confusion for international brands wanting to expand in China?

P.Z.: The number of social media platforms here is so scattered compared to the West. For Western brands to come here it can be very challenging. Social media is the backbone of brand-building in China. Besides Weibo, WeChat there are also apps like Little Red Book, Douyin or Chinese TikTok, and e-commerce platforms with a social element to them like Poison, which is the equivalent to StockX or Goat here and it has a number-one position in the sneaker resale market. It’s important to have a platform strategy for each.

Sign up for WWD's Newsletter. For the latest news, follow us on Twitter, Facebook, and Instagram.