CEO Talks: Patrik Frisk on Under Armour’s Growth Potential

Patrik Frisk sees a $120 billion pie.

That is the overall market opportunity the Under Armour chief executive officer believes is available as the activewear brand pursues its mission of helping athletes of all levels improve their performance. And he wants a bigger and bigger piece of it.

More from WWD

As Frisk completes two years in the corner office, he continues to focus Under Armour on that mission, along the way reminding the company’s employees of two vital principles he uses to guide himself on a daily basis. One is “if you don’t grow, you die” — meaning in the personal sense, as well as the financial one. The other is a word he invented: “simplicate,” a reminder to not overcomplicate things as he manages the company.

Frisk has a long history in the outdoor and active sports arena with a résumé that includes top jobs at The North Face, Timberland and Vans.

When the Swedish-born executive joined Under Armour in 2017 as president and chief operating officer, the once-high-flying company was faltering both in terms of sales, as well as with scandals ranging from strip-club visits to Securities and Exchange Commission investigations.

He instituted a $200 million, five-year turnaround plan with an unwavering focus on bringing Under Armour back to its roots as a sports brand. He jettisoned 2,500 wholesale accounts in North America, parted ways with many of the company’s long-tenured executives and doubled down on sports apparel, accessories and footwear.

At the beginning of 2020, Frisk took over as CEO from the company’s highly visible and hard-charging founder Kevin Plank, who remains Under Armour’s executive chairman.

Just as Frisk was settling into the CEO slot, the pandemic hit, and he drew on all his skills to keep the company moving forward. It appears to be working.

Despite supply chain issues that had Wall Street a tad jittery, the company reported net income above expectations in the fourth quarter and year in 2021. But for Frisk, he’s just getting started and he’s focused on continuing Under Armour’s mission to help athletes of all types keep getting better.

Here, Frisk talks about his vision for Under Armour, his victories and challenges and what makes him tick.

WWD: It’s been two years since you’ve been in the top position. How have you managed to navigate through this volatile situation?

Patrik Frisk: At first, no one knew what we were walking into in terms of the pandemic and our focus was on keeping our teammates safe, making sure we shored up liquidity and understood how to shut things down. Then we had to open everything up again.

The work we’d been doing over the last four-and-a-half years since I came into the business was to build a more resilient Under Armour, build a stronger leadership team, to have a better operating model. So I wouldn’t say we were ready — because I don’t think anybody could have been ready for what hit us — but we were certainly more prepared to take on what became a monster of a challenge. We’ve continued to perform, and the proof is in the pudding. We just came off the most successful financial year that Under Armour has ever had, so that’s a testament to the team and the resiliency we had somehow built into the model that we had before this pandemic hit. We never really took our foot off the gas as it relates to the investments that we had anticipated to do and that helped us to accelerate as we saw a more-open trading opportunity in the back half of last year.

WWD: Kevin Plank was the face of the brand since its founding in 1996. How involved is he these days?

P.F.: Kevin has a very clear role and mandate, he’s the executive chairman so he engages at a strategic level. Kevin and I have a very close working relationship. He still has the office next to mine so now that we’re open again, I’m sure we’re going to see a lot more of each other in person.

We’ve been working very closely together with the board through these last two years with all of these challenges that we’ve had, but he’s also been very busy making sure we’re staying on strategy. For me, it’s been really helpful. We have different leadership styles which is always the case when you have different backgrounds, but I think they complement each other. Through this time, it’s been an opportunity for me to lean in to Kevin in terms of his experience with the brand. And he’s been able to get the support from me as it relates to running this organization in this kind of time.

WWD: You talked about having different styles. How has the culture evolved over the past two years since you’ve been CEO?

P.F.: When Kevin brought me in, one of the things we both agreed upon is that we have a shared passion for Under Armour and for what has become a more-clarified road map as [we work] to make sure that this brand truly becomes eternal. We’ve both been very engaged in making sure that we have a framework for that and we’re not as dependent upon any one person or persons going forward. I think that’s part of my job here as I run the company and at some future date hand it off to whomever is next.

We have really identified and clarified the identity of the company, which is: We empower those who strive for more. What really differentiates Under Armour? Why do we exist? And why was Under Armour able to break through in the late ’90s when there were a lot of really good sports brands. What we came to see during [our extensive research], both internally as well as outside with the consumer, is that Under Armour actually has a very clear place in the world and a reason to exist — and that is to empower those who strive for more. And we do that through a vision of building performance solutions you didn’t know you needed and once you have them, can’t imagine living without. Ultimately, we go to work each day with a mission to make you better.

Zach Lewis

WWD: Has that clear mission helped you navigate through the pandemic?

P.F.: What has strengthened our ability to navigate through this very difficult period is our clearly defined values that we’ve been able to lean into and use to make decisions, communicate and guide us. We just announced how we’re taking a stand for equality in supporting Ukraine. That’s no different from what we did during the social unrest and the U.S. election campaign when we helped facilitate engagement in voting. I think that’s something that is very much in line with the cultural aspects of Under Armour and everyone who lives and works within the organization is very clear on that direction.

WWD: You’ve made a lot of personnel changes since you took over. What type of people do you gravitate toward?

P.F.: We had started to make changes before I came in — and I was one of the changes, I guess — but the difference now is that it’s a much more diverse leadership team in terms of gender and experience. Previously, as Under Armour was growing up as a brand, we had a lot of people who had been there for a very long time in leadership, but it was clearly time for us to start to pivot four or five years ago into a broader experience set.

We were also becoming a more global and larger company and we needed to be managed in a different way. Today, about 70 percent of the people on my leadership team would be considered “new” within the last four years. It’s a very experienced set of individuals — I have three former CEOs reporting in to me — who have really admirable experience to be able to do what we’ve set out to do, which is create this eternal brand that can have longevity, growth opportunity and resilience in a very difficult global environment.

WWD: The company had a history of being a male-dominated business but you’ve moved to be more inclusive in terms of women and different cultures. Is that part of your strategy, too?

P.F.: Absolutely, and I’m very proud of that. It even goes down into our athletic roster. Here in North America, we support around 450 various collegiate teams, about 1,800 high schools and about 1,900 travel teams — in all, about 55,000 teams and 1.4 million athletes. And what’s interesting in that profile is the amount of women we support — it’s about 40 percent. I think that’s a pretty dramatic change both in the leadership of the company, through the ranks, all the way to the athletes we sponsor and engage with on a daily basis.

WWD: You’ve talked about providing access to sport for everybody, whether they can run a five-minute mile or a 13-minute mile or just want to walk around the block. Are you working to attract them as well?

P.F.: We were very much a company that was product-led and there was a strong desire internally as we were evolving our culture to really become more purpose-led. We understood that was one of the reasons for us to exist, but do you want to know what makes people here at Under Armour really mad? We were very concerned with peoples’ ability to participate in sport — whether it’s as simple as having access to a facility, but also through gender or race or culture or even through access to equipment. We’ve seen through the years this has become harder and harder, especially for youth. Here in North America, it’s becoming increasingly expensive if you want your children to participate. We know all of the benefits of youth participating in sport in terms of engagement, health, mental health, attention, etc. So we made that our cause.

Our mission is to get millions of youth engaged in sport by taking down barriers to entry by 2030. And this is something we’re now working across a number of different initiatives. We’ve bucketed them around people, pathway and performance, and for us, with all the engagement we have with teams, schools, organizations, we have an opportunity to be driving various initiatives that can make it easier for you to participate or have access to sport. Some of it we’re already doing through some of our athletes: Steph Curry, for example. We’ve already committed to helping him in his quest to do the same thing and he has a very ambitious program to activate and get kids to be able to play the game. And there will be more activations like that as we move into the future.

WWD: What about older people, are you working to engage with them as well?

P.F.: Yes, ultimately, our mission is to make you better and we’re making sure we’re doing that in many different ways. What you’ll see from Under Armour going forward is that there’s certainly a place for product — that’s still the main thing for us in terms of how we connect and engage with people — but we’re also taking this to another level.

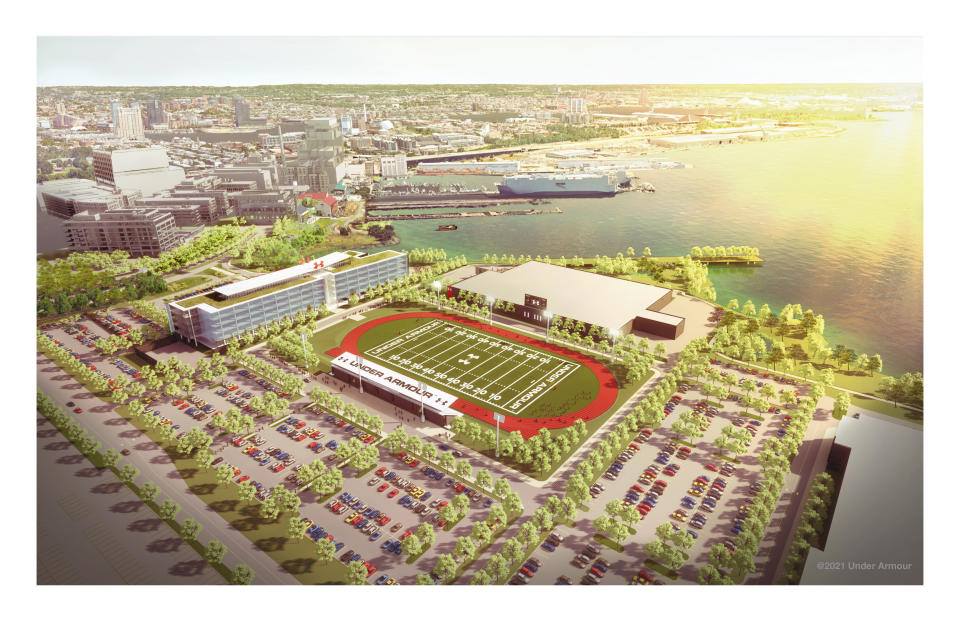

One of the things we’re doing is we are consolidating our three campuses in Baltimore into one that will be our new global headquarters. We’re doing that in two stages: the first is for our design, product and innovation [departments], and that opens in June of this year. We’re also building a net-zero campus which will probably be one of the most advanced, environmentally conscious campuses in North America, and we’re going to be moving into that in 2024. Inside of that, we’re building a research facility for human performance to democratize the information we get from working with some of the best athletes in the world to help [regular] people get better. Every person ultimately has their own journey and goals and they go through their own struggles to get to their results, and our job is to facilitate that to the best of our ability. And we think there’s opportunity for Under Armour to be that brand.

Bohlin Cywinski Jackson

WWD: Don’t you have a performance facility in Oregon?

P.F.: Yes, we do. That has been hugely successful for us and we’ll keep that facility because we work with a lot of our schools and athletes on the West Coast there, but here [in Baltimore] we’re building a truly global performance center and research facility to integrate the work we do with outside partners like Johns Hopkins and various universities around the world and sports institutes in Germany. It will be an open source platform for us where people can come in and do research, and our athletes can to come in and get better as well. We’ll be marrying that work with what we do in the innovation [lab], which sits right next to it, so it’ll be a really integrated opportunity for us to drive what we call the human performance system, which is a holistic way to look at human performance through product training, nutrition, sleep and other things that might impact how you perform.

WWD: The company had made a big commitment to connected fitness but you sold MyFitnessPal in 2020. Where does connected fitness fit into the business today?

P.F.: If you go back to 2013, we bought a number of different applications — MyFitnessPal, Map My Run, Map My Bike — that we had in a portfolio. We did sell MyFitnessPal, which was the largest app, but it was based solely on nutrition and we’re moving toward a more holistic approach so you can access the world of Under Armour and navigate inside of that to transact and have access to information, coaching and other things. So that was an outcome of those investments and we’re starting to benefit from those now as we move into the future.

WWD: You zeroed in on Under Armour as a pure sports brand and got away from the other clutter that had developed around the brand. How has that worked out?

P.F.: It’s been the right decision if you think about our performance in 2021 when we had the highest sales, the highest margins and the highest operating profitability and the highest earnings per share that we’ve ever had. But it’s also about the engagement from the consumer: our ability to drive awareness, consideration and ultimately conversion has improved dramatically when we refocused the brand. I believe every brand has a reason for being, what we needed to do for the consumer was to clarify that.

There was a time when Under Armour was sending out a lot of different messages. We had grown the fastest of any sports brand ever for the longest period of time, but when you got to the end of that, we had also become distracted, too unfocused and we were sending way too many messages. The consumer never left Under Armour, they never disliked Under Armour, but what we saw in the data is the consumer was confused and didn’t understand why Under Armour mattered anymore.

So all we needed to do was to clarify that around what we call the Focused Performer Mindset. If we’re focused on the consumer in a moment when they’re about to do an activity with a way for that consumer to get better, there’s a high opportunity for us to get bigger as well. We saw that as a $120 billion opportunity for us. We said we’re about $4 billion or $5 billion right now, would it be possible for us if we’re focused, to become bigger within that $120 billion versus trying to do something else we don’t really know how to do, the consumer doesn’t really understand and we have to invest in? That’s what we’ve been focused on fully over the last two years and now it’s about being disciplined, consistent, continuing to drive innovation and messaging and connect with the consumer and really deliver on that mission of making you better.

WWD: Where do fashion and lifestyle product fit into your strategy?

P.F.: I get that question the most from investors and I answer this way: I don’t understand why people would bifurcate performance and style because if we don’t make things that people would like to wear, they’re not going to buy it. We’re going to make awesome, beautiful performance product and the consumer will pull that product into different wearing occasions. I don’t think you have to give up on style or trend just because you’re making a performance product.

For us, that means we have to be on trend in everything from fit to color to style to relevance. One of the biggest parts of the work we do today in terms of research is around recovery. If you think about an athlete, you don’t work out all the time. You’ll perish if you try to work out 24 hours a day. Someone who’s super active might work out two times a day, but it’s usually a two- or three-hour endeavor at most. So for me, there will be items that are making you better while you recover that are going to be pretty trendy and stylish that people are going to use for more wearing occasions than just lounging around.

WWD: Where do you envision the growth coming from in the future?

P.F.: I truly believe our core business, our training business, will continue to grow. The athletic trend coming out of the pandemic will be the natural organic growth. But disproportionately, we have an opportunity in women’s. Our women’s business is doing much better but there’s still an opportunity for us to have more presence there. Footwear is also a big opportunity.

If you would have asked me before I started working with Under Armour whether it could be conceived as a running brand, I would have been a little skeptical. Well, I’m not skeptical anymore. We really relaunched our running business in 2018 and we now have three distinct platforms in Charge, HOVR and Flow so there’s a big opportunity for us across gender and across the world.

And the fourth thing is international growth. We continue to grow disproportionately in both APAC and EMEA but the reality is that we’re far from well-penetrated yet. I always think of it this way: I always want to be with a brand that is bigger than its business. And I think Under Armour punches that card. The consumer believes Under Armour is on par with our much bigger competitors. But the reality is that we’re much smaller and that opportunity to grow into that mindgap is very real. That’s where that $120 billion opportunity comes from.

WWD: So you don’t see yourself partnering with any of the big, European luxury brands?

P.F.: I’m not saying we would never do that, but we are so laser focused on our promise to the consumer to make them better. There is just so much runway for us to do that even better, so we’re going to focus on that first.

WWD: You made a bold move to reduce wholesale accounts. How do you feel about that decision?

P.F.: I feel really good about that. We’ve exited about 2,500 doors in North America and it was clearly the right decision. Being consistent in terms of how the brand shows up across all touchpoints for the consumer was hard to do across the doors we used to have, so we made a conscious decision to focus on to the doors we can control and on our own direct-to-consumer.

WWD: Speaking of that, your Brand Houses were a big push for you for a while — what’s your thinking now on brick-and-mortar?

P.F.: I think brick-and-mortar has to be an informed part of what we do going forward. The consumer is in charge so for us, understanding where and when they decide to engage, what kind of content and experience they’re expecting and delivering against that is the name of the game going forward.

One of the interesting observations over the past 12 months, as this pandemic has ebbed and flowed across the world, has been how the consumer has ebbed and flowed, too. We’ve seen shifts in terms of online traffic and then back into stores and then back into online and what it tells you is you’ve got to be ready and flexible and agile. And if you’re going to be able to do that, you’re going to have to have retail stores too because the consumer is going to want to go into retail. And if you’re a brand, you’re going to want to clearly define your brand in a real space, not just in a digital world at some point. And that’s why I believe retailing is going to be really important — it’s going to evolve, but it’s going to be a really big part of our future for a long time to come.

And also, the areas where we saw retailing being done in the past might not be as relevant and you might see new areas that pop up as well as new formats and types of engagement — that’s an area to really experiment in going forward. One of the things we’ve done over the last few years is really become much better retailers, much better e-commerce executioners, much better direct-to-consumer enablers and that is what we’re now building on going forward.

WWD: But you’re still not going to open that store you had committed to on 58th Street and Fifth Avenue in New York City?

P.F.: No, we’re working through that. That city is still going through the aftermath of the pandemic, and traffic patterns are not back to where they were. For big cities like New York, though, I think traffic will return — maybe not to pre-pandemic levels, but to very strong traffic. And there will be a place for [locations] like that for some brands, but for Under Armour, that’s not necessarily the right location or the right format for us. So we’re going to move on from that space but we continue to open a lot of stores around the world on a weekly and monthly basis even now, so there’s a lot of focus on other places to open doors right now.

Shawn Hubbard @shawn_hubbard

WWD: You recently announced a substantial $500 million share purchasing program. Why did you decide to do that?

P.F.: We left 2021 with $1.7 billion in cash and we saw an opportunity to put some of that cash to use in a good way. Our board and our bankers thought it was the right time to do it. That shows strength in terms of how we think about our financial position and we’ve never done that before, but we’ve never been as financially strong as we are right now and that enabled us to do it for our shareholders.

WWD: How are you different from Nike, Adidas or the other big brands?

P.F.: We’re an athletic performance brand. I say that with a little tongue in cheek, but we’re not a sneaker brand, we’re very focused on making you better. I think that’s an incredible mission to have and we’re going to stick to it. We believe that has longevity and we can grow and get better and also become truly eternal. It’s a truly sustainable business [model].

WWD: Let’s talk a little about you? What do you like to do?

P.F. I like to do what Under Armour likes to do. I’m incredibly active. When I travel with the team, which we have been doing through the pandemic, we work out together in the mornings. It’s a religion here, no matter where we are in the world. When I’m not at work, which is almost never, I spend a lot of time doing various activities around exercising, but I’m also very passionate about the outdoors. I spend a lot of time in the mountains, in nature, I do that with my kids and my family. I have the fortune of having two Division 1 athletes: one a soccer player, the other a skier, so we’ve lived the NCAA life as a family and we grew up with it through high school and travel teams. So my entire life has revolved around sport and outdoor pursuits, including my career.

I’ve run the largest outdoor brand in the world, The North Face; the largest outdoor footwear brand in the world with Timberland; been involved with regionally leading the largest action sports brand with Vans. But I’ve always wanted to learn and when I left VF Corp. in 2014, I went to Aldo in Montreal and I was exposed to fashion footwear, which was something I didn’t know much about. I’m a lifelong learner and I have two sayings on my wall in my office: one says, “If you don’t grow, you die.” People get a little frightened by that because they think it’s all about financial growth, and you have to grow as a financial enterprise or you won’t survive, but it’s also about personal growth. The second saying is “Simplicate.” It’s a word that doesn’t actually exist, I invented it because it’s the opposite of complicate. When you have a leadership position for large organizations, my job is to simplicate things. It’s a very complex world and it’s getting more complex, so I keep that to remind myself not to get too convoluted or complicated in terms of what I’m trying to accomplish. Those are the two things that keep my head straight on a daily basis. I’ve been very fortunate in my life to grow great leaders and to run some of the most amazing brands that the world has ever seen in what I believe is one of the most exciting sectors. It’s been one hell of a ride.

Sign up for WWD's Newsletter. For the latest news, follow us on Twitter, Facebook, and Instagram.