Art Basel bounces back as galleries report brisk sales in the 'sweet spot of $500,000 to $5m'

Yesterday evening the doors closed on the 51st iteration of Art Basel, widely regarded as the most prestigious modern and contemporary art fair of all; "the Olympics," it has often been said, "of the art world".

After 18 months of online action only, it was not always certain this Art Basel would happen. Last year, its parent company, MCH, was reportedly $200m in debt until it was rescued by media tycoon James Murdoch. Said to be the most profitable in MCH’s portfolio of events, Art Basel has not revealed the revenue loss from fair cancellations.

Gallery fees range between $34,000 and $100,000 each for the 750 or so booths spread over its three locations in Miami and Hong Kong as well as Switzerland annually. So signs of desperation were to be expected when the prospects for this year’s Art Basel, already postponed from June to September, began to look shaky in the shadow of the Delta variant. Americans were advised not to travel to Switzerland, and visitors from Asia who had not quarantined were blocked.

Some galleries asked for another postponement; but Art Basel dug its heels in. Its organisers offered a $1.6m insurance scheme to cover galleries that did not sell well, effecting an average 10% reduction in stand costs, and issued confidence boosting market reports and reassurances that the fair would be a safe place to visit. In the end all 272 exhibitors came good.

On the opening morning, the first of 60,000 visitors passed advertising billboards by British artists, Art & Language, that read ominously: ‘A BAD PLACE’, and then into the main square where a theatrical performance by dancers inside transparent bubbles was taking place outside the entrance.

Instead of the usual rush to get in first, visitors queued patiently in a tent opposite to get their Covid test passes in the shape of black wrist bands that would allow them into any public gallery, fair or restaurant in the city. The comparison with nightclub passes was not too far-fetched – in this case, the sign of a very exclusive kind of club membership.

Most dealers I spoke to were extremely nervous about business going into the fair but did much better than expected. Although the Asians and Americans were not there, European collectors and institutions kept things going at a pleasantly unfrenzied pace.

Amongst the predominantly European collectors seen cruising the aisles at the opening were Swiss billionaire Maja Hoffmann, private museum founder Udo Brandhorst from Munich, Robbie and Daniella Antonio from Manila, Freda and Izak Uziyel from London, Slovenian millionaire investor Igor Lah, and Brussels private museum owner Walter Vanhaerents. The fair was also teeming with museum directors and curators.

Art Basel is the kind of place where you would expect to find $20m plus artworks, but this year, they were few and far between. “The sweet spot here is between $500,000 and $5m”, explained Brett Gorvy, co-founder of Lévy Gorvy galleries in New York, London, Paris and Hong Kong. Just creeping into that bracket was his sale of Jet Blue, a reclining female bedecked in rhinestones by in demand African American artist, Mickalene Thomas, whom the gallery is going to show in London during Frieze week.

Lists of reported sales ran into the hundreds of millions of dollars. They were headed by the $6.5m paid at Hauser & Wirth for a cartoon style painting by Phillip Guston whose major retrospective in London was postponed because of his references to the Klu Klux Klan. At a less exalted level, James Mayor was selling paintings by Congo the Chimpanzee from the Desmond Morris collection at £5,000 each.

Among the more inventive displays was an homage to Joseph Beuys, the hugely influential German artist whose centenary is this year, by New York dealer Lucy Mitchell-Innes. A rare million dollar plus large blackboard with chalk drawings by Beuys occupied the centre of the stand flanked with recent works by contemporary artists that referenced the famous Beuys felt suit and vitrines.

London gallery Victoria Miro also tipped its hat to age and experience to show just three older generation figurative painters including the late Alice Neel and Paula Rego, who they recently won over from the Marlborough gallery. They sold three of Rego’s large pastels, including ‘Meeting Adeline’, for between £200,000 and £300,000 each.

The fair marked "a return to historical vales" said American dealer, Rachel Lehmann, who nearly sold out in a day placing several abstract works from the 1980s by the late Swiss artist, Heidi Bucher, in the 200,000 to 450,000 Swiss francs range.

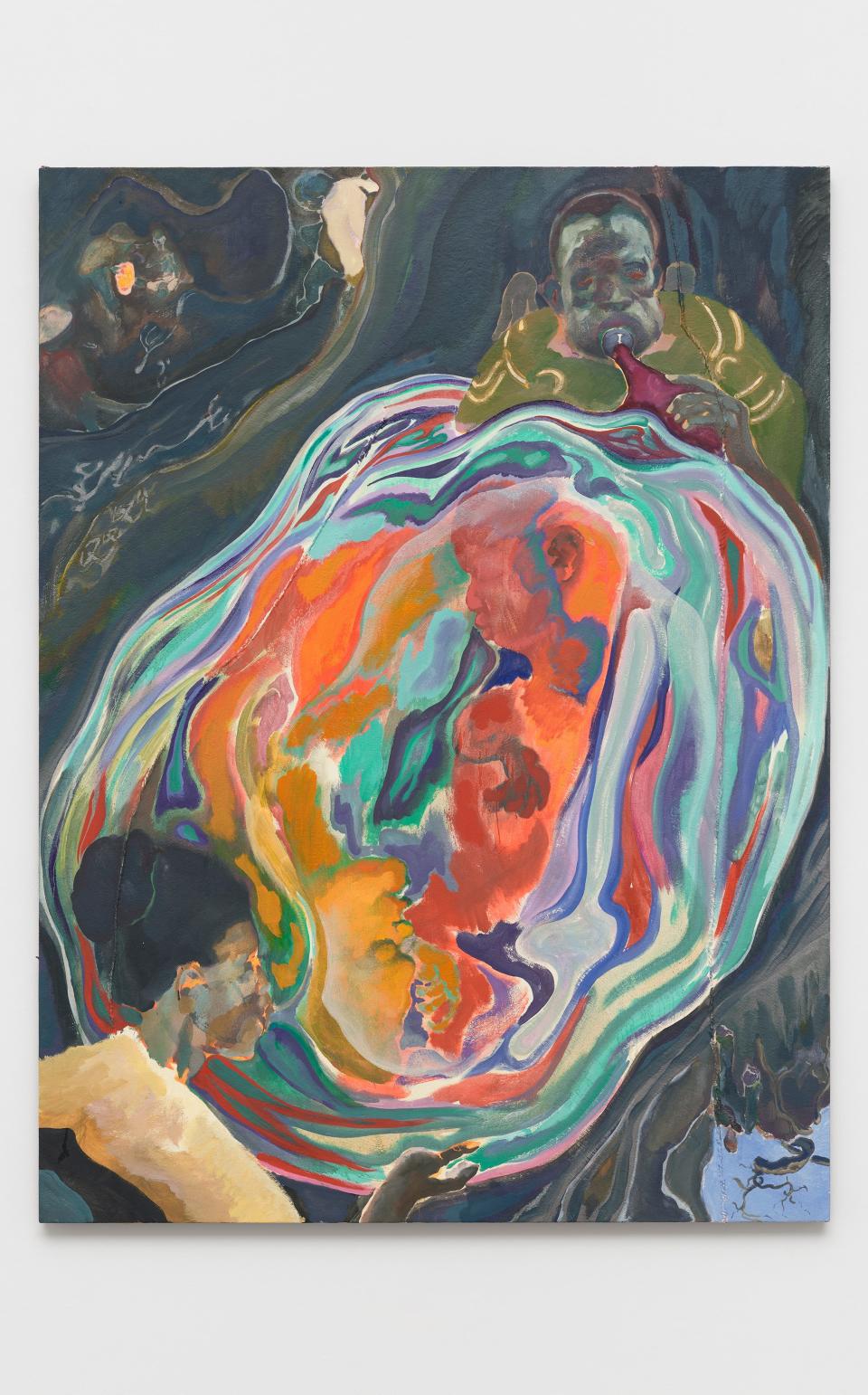

But sales were also strong for new work by younger artists. A new painting by 37-year-old Kenyan born Michael Armitage, whose show at the Royal Academy has just closed, sold for £600,000 at White Cube. London gallerist, Pilar Corrias, who specialises in younger artists, sold so much she had to rehang her stand every day for three days.

Among the more expensive was a dramatic work by 31-year-old African American auction sensation Tschabalala Self who has a waiting list of collectors wanting to buy. ‘Candy’, Self’s eight-foot collage of a reclining woman, sold for between $200,000 and $300,000. Perhaps most successful was 38-year-old Chinese painter of futuristic architecture, Cui Jie. All four paintings she took to Basel sold for between $60,000 and $80,000 to buyers from America, Europe and China.

“During the pandemic there has been a lot of online buying. Many of these were new buyers to us,” said Corrias, “and at Basel we had the opportunity to meet some of them in the flesh.”

By the third day, though, the aisles had become noticeably thinner. Several dealers, like Iwan Wirth, whose gallery chalked up over $20m of sales on the first day, were heading to the airport, their main business done – but all happy to have done deals on a handshake again and looking forward with optimism to the major fairs in London (Frieze) and Paris (FIAC) next month.