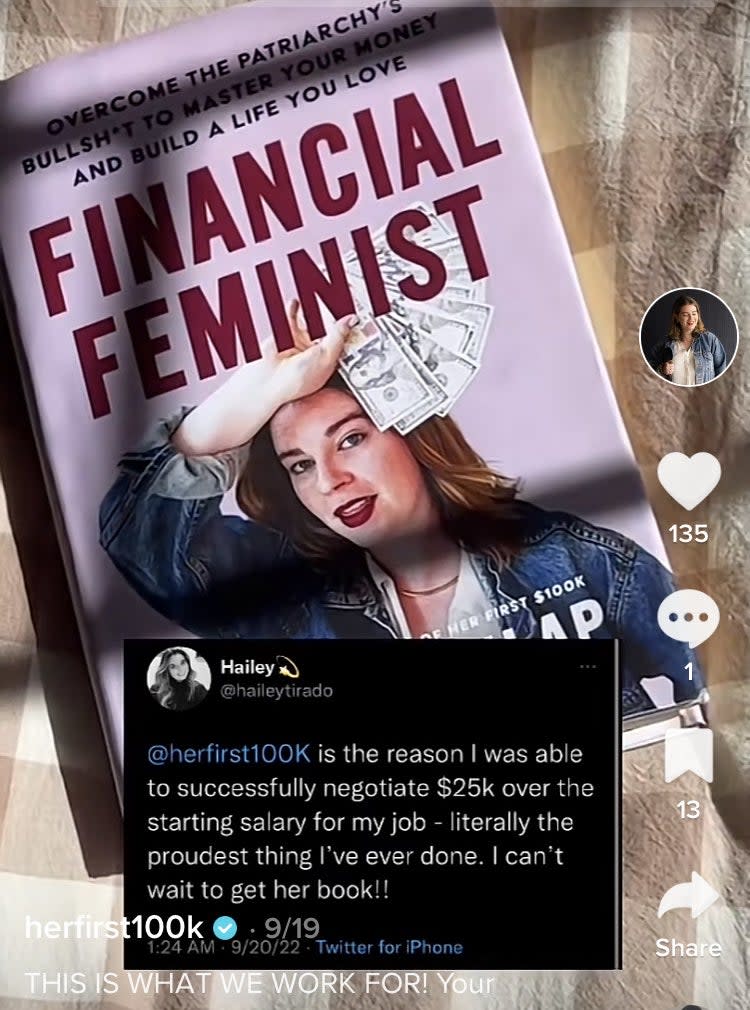

"How To Prepare For A Recession": TikTok's Favorite Financial Feminist Shared Her 6 Tips For Getting Ready For Hard Times

Tori Dunlap, known on TikTok as @herfirst100k, is one of my absolute favorite financial influencers. From her empowering story and practical advice to her shame-free approach to money, there's a whole lot to love about Tori.

So when she shared her tips for getting recession-ready, I had no choice but to slide into her DMs to learn more.

In the video, Tori recommends brushing up on your résumé, diversifying your income, having three to six months worth of living expenses in an emergency fund, adjusting your budget for inflation, making sure your emergency fund is in an high-yield savings account (HYSA) to earn more interest, and paying off high-interest debt.

So let's look a little deeper at each of the six steps she mentions in her video:

1.The job market can get unpredictable in times like these, so it can't hurt to be ready to apply for new roles, just in case. What exactly does it mean to touch up your résumé in 2022? Tori says that the most common mistake she sees are résumés that just don't have enough information to stand out. "It's important to include clear details about what you accomplished at each position. It's not enough to just list tasks and responsibilities — you need to highlight how you show value."

So include things like numbers, dates, and other metrics that illustrate the work you did. Like, if you work in customer service, instead of writing, Answered calls and resolved client issues, try something like, Resolved an average of 50 client complaints per shift with a 98% satisfaction rating. If you're not sure where to pull numbers from, think about the metrics your manager looks at to determine your performance, and that should point you in the right direction.

Tori went on to say, "On average, hiring managers initially look at each potential candidate's résumé for six to seven seconds. That's it. So, it's important to clearly show what sets you apart and makes you perfect for the role. That also means that you need to tweak your résumé for each role."

2.Next, we talked about ways to make more cash by diversifying your income. Tori says that the best way to earn more on the side is to lean into what you're already good at and what you enjoy doing. "Maybe you're super organized and can work as a part-time virtual assistant. Maybe you love Instagram and can help a company or influencer with their social media accounts. Maybe your can look into food delivery on the weekends for a few hours or coach sports at a local YMCA. The options are endless!"

But she also emphasizes making sure that you still make time to take care of yourself too. "The most important aspect is to choose a side hustle that won't burn you out and ideally will add some value to your life. I also have a Financial Feminist podcast episode where I discuss side hustles."

If you're looking for even more side hustle ideas, a BuzzFeed contributor who's tried 20 different ones recently ranked them from meh, not worth it, to OMG yes, and it's a great place to start.

Alternatively, if the idea of taking on a second job makes you absolutely want to vomit, this could be a great time to start building a case with your manager for why you deserve a raise. With the end of the year coming, now's the time to have the talk before budgets get set for 2023.

3.Step three is ~ideally~ having three to six months worth of expenses in an emergency fund, but don't sweat it if you're starting from zero — you're not alone! Tori says you can start saving toward a smaller goal and work your way up to saving more and more. "You don't need to be stressed as long as you develop a plan." And I would like to add that even if you never reach the three- to six-month ideal savings goal, every dollar you can put away for emergencies can save you from taking on a dollar in high-interest debt.

I'll let you in on a secret — I'm a personal finance editor, and I've never met this savings goal myself because stuff keeps happening (vet bills, car repairs, medical bills, and on and on).

But I've always been glad to have at least something in the bank when shit hits the fan. Whatever money you're able to save will save you some day — believe me.

To figure out what you can save, Tori says, "You need to sit down and take a hard look at your finances. That means going through bank and credit card statements to figure out exactly where your money is going. After that, it's time to create a budget and create 'money dates' with yourself to check in monthly to see if you're sticking to your budgets."

Never made a budget before? See what happened when a financial pro helped one BuzzFeeder create her first budget step by step.

4.Now it's time to adjust your budget for the dreaded I-word: inflation. Since prices keep on going up, Tori says, "Now is a great time to trim your budget. Comb through your spending and find things that you could cut back on. Maybe opt for streaming services instead of cable or buy weights for home workouts instead of a pricey gym membership."

Where (or if) you're able to cut expenses really depends on your personal spending and needs, so these things will look different for everyone. Some things I've done recently that cut my spending include crossing items that have just gotten too expensive off my grocery list, switching to a cheaper pre-paid phone plan, and adding a couple of weekly "no-spend days" to my routine.

5.Whether you have an emergency fund already or are starting from scratch, Tori says it's super important to make sure your money is in a high-yield savings account, HYSA for short. Tori says an HYSA, "is an account that makes your money work harder for you by giving you something back in interest rather than a traditional savings account that has minimal or zero interest."

And she says these accounts are paying off even more since interest rates are rising. "Right now, HYSA interest rates are significantly higher than they were one year ago, so it's even more crucial to keep your money there." You'll often find these accounts through online banks, like SoFi, which Tori has a partnership with.

6.And finally, it's time to talk about everyone's least favorite subject: debt, high-interest debt to be specific. Tori says, "Credit cards have APR (annual percentage rates) that can be as high as 24%, whereas [federal] student loans can be around 5%. It's better to focus on paying off debt with the highest interest rate because that is how much the company is charging you for having that debt." Basically, this kind of debt is more expensive, so the sooner you pay it off, the better.

Leading up to a recession, she says, "People can pay off the minimum for low-interest debt and pay as much as they can for high-interest debt. They should call the company whether it's a credit card issuer or bank to make sure the payments are going toward the principal balance (the amount still owed on the original amount financed without any interest or finance charges that are due)."

Finally, Tori says that getting your money in order is especially important for women. "The very act of a woman getting her financial shit together is feminist. The heart of Financial Feminism is embracing your power and not only using it to get ahead but to help others get there too."